Overview

Trust score

Tradeable Symbols (Total): 1260

Year Founded: 2006

Publicly Traded (Listed): No

Bank: No

AvaTrade is considered low-risk, with an overall Trust Score of 93 out of 99. AvaTrade is not publicly traded, does not operate a bank, and is authorised by four tier-1 regulators (high trust), four tier-2 regulators (average trust), and one tier-3 regulator (low trust). AvaTrade is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC), Investment Industry Regulatory Organization of Canada (IIROC), Central Bank of Ireland (CBI) – Ireland , and the Japanese Financial Services Authority (JFSA) . Learn more about Trust Score.

Our testing found AvaTrade to be great for copy trading, competitive for mobile, and generally in line with the industry average for pricing and research.

Pros 👍🏻

- Founded in 2006, AvaTrade is regulated in three tier-1 jurisdictions and three tier-2 jurisdictions, making it a safe broker (low-risk) for trading CFDs and forex.

- Alongside MetaTrader, AvaTrade offers its proprietary platforms AvaTrade WebTrader and AvaTradeGO, with innovative features such as AvaProtect.

- The AvaOptions app, powered by Sentry Derivatives, provides AvaTrade clients with an excellent forex options mobile trading platform.

- AvaTrade offers 44 forex options, in addition to over 1,200 CFDs.

- AvaTrade offers AvaSocial, along with ZuluTrade and DupliTrade for social copy trading, and finished Best in Class for 2022.

- AvaTrade ranks Best in Class for Professional traders for 2022.

Cons 👎🏻

- Pricing for retail accounts is in line with the industry average, but trails industry leaders.

- The AvaOptions desktop platform is slow to load, and has an outdated design that doesn’t match up with the sleek responsive design of its mobile counterpart.

- Out of 1,260 available symbols, at least 351 are on hold for both the MetaTrader and WebTrader platforms at AvaTrade.

- Research is limited to Trading Central modules, and just one or two daily articles and videos.

Offering of investments

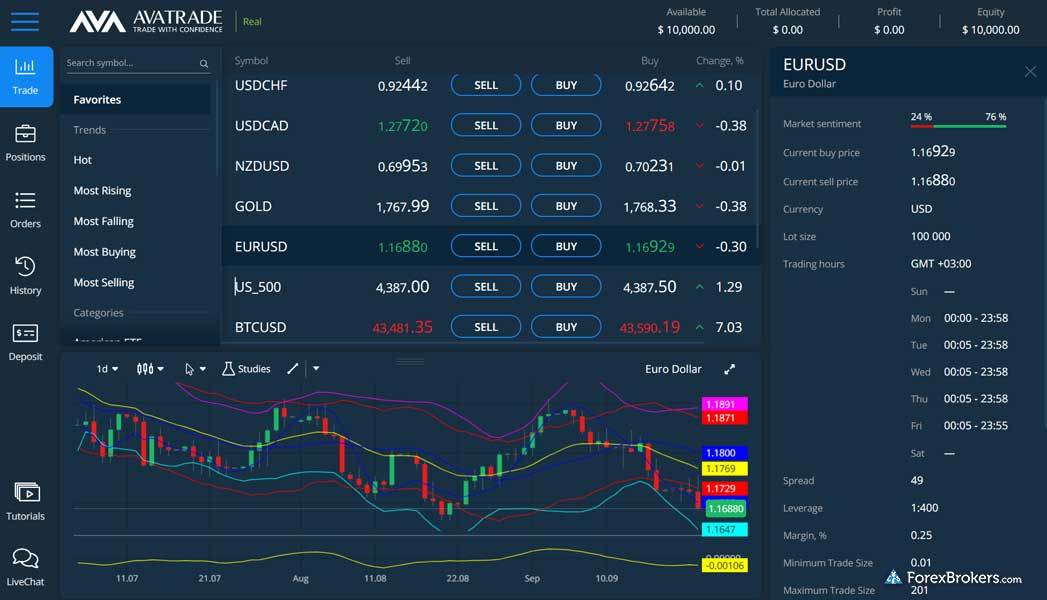

The range of markets available at AvaTrade will depend on which trading platform you choose, and which of the brand’s global entities holds your account. AvaTrade offers 1,260 symbols in MT5 and nearly the same number in WebTrader, though a few hundred of those symbols have been put on hold.

The following table summarizes the different investment products available to AvaTrade clients.

Cryptocurrency: Cryptocurrency trading is available at AvaTrade through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 1260 |

| Forex Pairs (Total) | 55 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

AvaTrade’s spreads are close to the industry average at just under one pip (0.9 pips), yet are slightly higher than the spreads available on the entry-level accounts offered by CMC Markets and Tickmill.

Professional traders: If you qualify as an elected professional trader, spreads on AvaTrade’s Professional account are competitive at 0.6 pips and comparable to FP Markets.

| Feature |  |

| Minimum Initial Deposit | $100 |

| Average Spread EUR/USD – Standard | 0.91 (Aug 2020) |

| All-in Cost EUR/USD – Active | 0.61 (Aug 2020) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

Mobile trading apps

AvaTrade’s proprietary apps provide a mobile experience that will satisfy most traders (including beginners), though they aren’t quite as advanced as the mobile apps provided by category leaders such as Saxo Bank, CMC Markets or TD Ameritrade (U.S. residents only). That said, AvaTrade continues to make incremental improvements in this category, and provides a generally well-rounded suite of apps.

Apps overview: AvaTrade provides its own proprietary mobile platforms, AvaTradeGO and AvaOptions, as well as the full MetaTrader suite (MT4 and MT5) for Android and iOS devices.

Ease of use: The AvaTradeGo app closely resembles its web counterpart, and features a robust default set of syncing watchlists as well as a volatility protection feature called AvaProtect. AvaProtect allows a trader to reduce the risk on an open trade by partially hedging their position with a forex option – for an added cost.

Charting: Charts in the AvaTradeGo app come with 93 indicators – though I found that it took multiple steps to access them. However, there are no drawing tools and only three selectable chart types. Trading Central provides integrated research and related tools, mirroring what’s available within the web platform. Overall, mobile charts at AvaTrade are good, but have room to improve.

AvaOptions: The AvaOptions app is well-designed, and takes a unique approach to displaying option-chain data. AvaTrade overlays strike prices onto a chart, allowing traders to change the strike price simply by dragging it higher or lower – a feature I found to be incredibly helpful. There are also 14 default options-trading strategies available, and selecting an option plan will automatically populate the order ticket with the related options contracts. One notable annoyance: the entire app experience was displayed in landscape mode, forcing me to hold my phone like a gaming controller.

Gallery

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 6 |

| Watchlist Syncing | Yes |

| Charting – Indicators / Studies (Total) | 90 |

| Charting – Drawing Tools (Total) | 13 |

| Mobile Charting – Draw Trendlines | Yes |

| Charting – Multiple Time Frames | No |

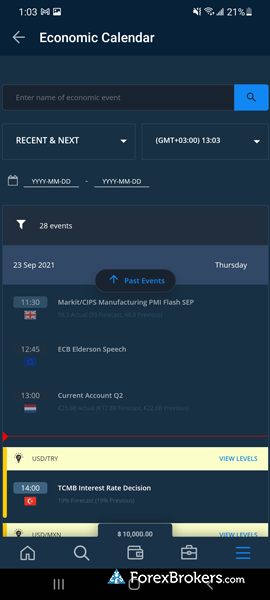

| Forex Calendar | Yes |

Other trading platforms

Thanks to AvaTrade’s extensive offering of copy trading platform options, AvaTrade once again finished Best in Class for Copy Trading in 2022.

Platforms overview: AvaTrade offers two proprietary platforms (AvaTrade WebTrader and AvaOptions), the full MetaTrader suite, ZuluTrade, and DupliTrade (accessible via WebTrader).

Charting: Charts on AvaTrade’s WebTrader platform come with 90 indicators, 13 drawing tools, 10 ten time frames, and three chart types. That said, WebTrader still has a ways to go if it wants to compete with the depth and rich quality of features found on proprietary platforms from industry leaders such as IG, Saxo Bank, and CMC Markets. For example, I discovered a platform bug that caused chart data to appear compressed. As a result, I constantly found myself having to constantly zoom out by dragging up or down to decompress the prices.

Trading tools: I found AvaTrade’s proprietary WebTrader platform to have a well-designed responsive layout. AvaTrade won our award for #1 Innovation in 2021, due to the speed of its evolution as a new platform. I was also pleased to find a suite of trading tools from Trading Central directly integrated within the platform. Though alerts are only found in the mobile version, the AvaProtect feature is included in both platforms.

Copy trading: AvaTrade’s steady progress in expanding and enhancing its copy trading offering has helped it compete with industry leaders such as eToro and Pepperstone. AvaTrade offers ZuluTrade, DupliTrade, and the native Signals market in MetaTrader. In addition, AvaTrade launched AvaSocial in the U.K., as part of its partnership with Pelican Exchange.

AvaOptions: For options traders that deposit at least $1,000, AvaTrade provides AvaOptions – its forex options platform for desktop and mobile. The desktop version is for Windows only, and requires that users install Microsoft’s .NET Framework 3.5 SP1. As a seasoned trader, even I found the platform layout to be complex. Clearly suited for professionals, the platform needs a design overhaul.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | Yes |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | 90 |

| Charting – Drawing Tools (Total) | 13 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 6 |

Research

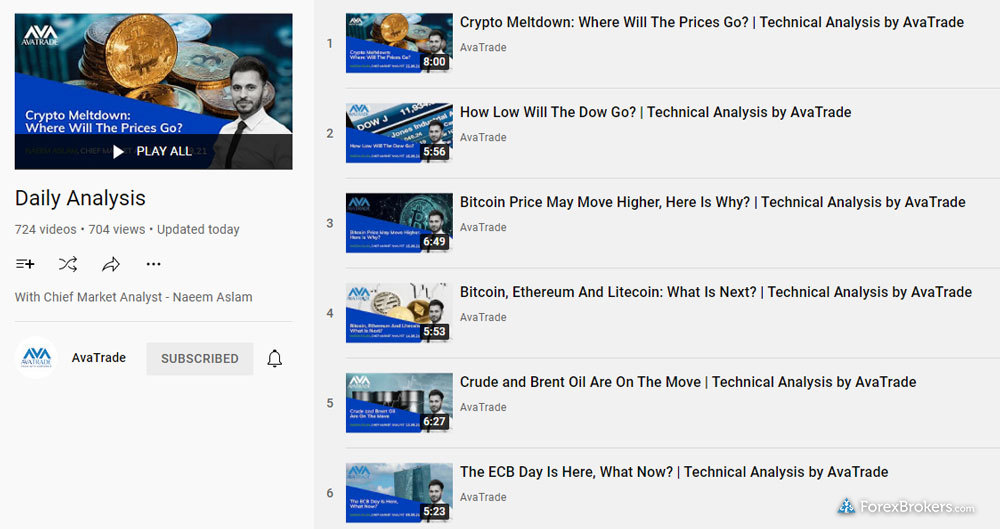

AvaTrade produces daily in-house research content in video and article format, and grants access to Trading Central research modules. While AvaTrade has made improvements in this category, its research offering can’t stack up against what the best forex brokers offer.

Research overview: Beyond AvaTrade’s support for ZuluTrade, AvaSocial, and DupliTrade for copy trading, the main highlight from AvaTrade’s research offering is Trading Central. Trading Central is directly integrated within the AvaTrade web platform and includes a variety of TC-powered features, such as its Market Buzz, Analyst Views, and Featured Ideas tools, as well as an economic calendar and streaming news (available in MT5).

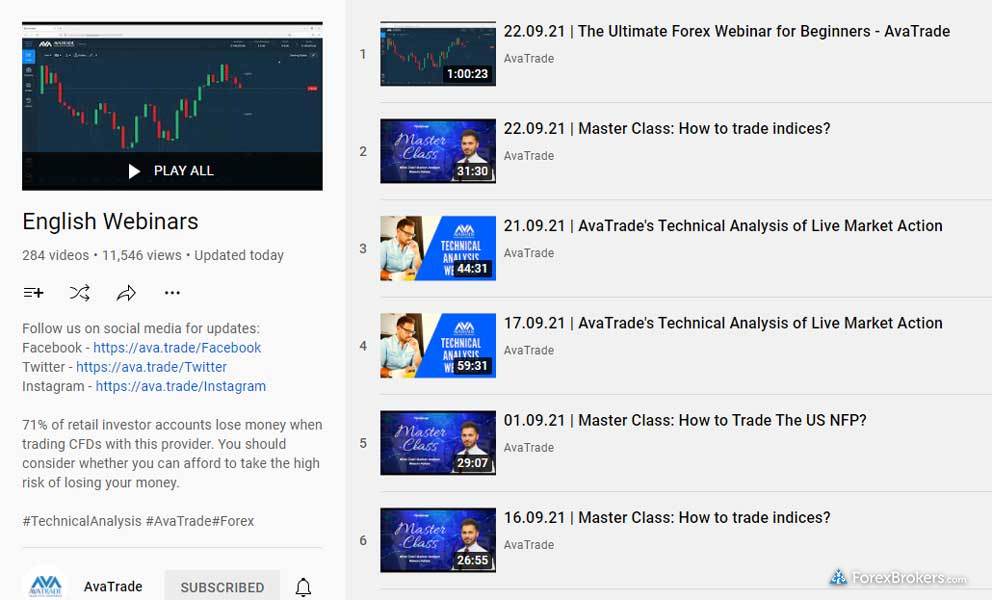

Market news and analysis: AvaTrade provides daily market analysis articles on its blog, along with daily market video updates published to its Vimeo and YouTube channels.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

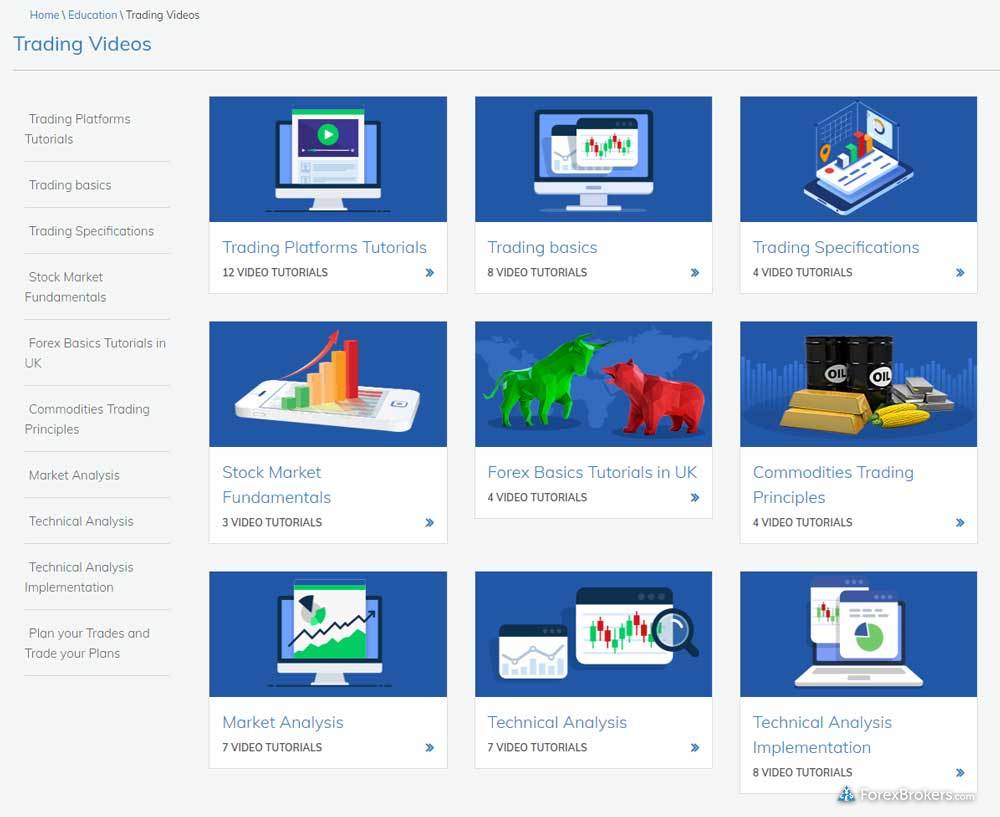

Education

AvaTrade provides a rich array of educational content from its in-house staff and its SharpTrader brand, as well as from third-party providers such as Trading Central. AvaTrade finished Best in Class in our 2022 review, taking second place for Education.

Learning center: AvaTrade’s website features 103 comprehensive articles that cover beginner and advanced topics. As part of its SharpTrader offering, AvaTrade provides in-depth courses that are organized by experience level. These courses include both video and written content, and feature progress tracking and integrated quizzes.

AvaTrade’s 48 educational videos cover a wide range of topics, and explore niche subjects like Donchian Channels (what they are, and how traders can use them). AvaTrade also uploads and archives video webinars on its YouTube and Vimeo channel, which help to round out its offering.

Room for improvement: Platform tutorials notwithstanding, the WebTrader and AvaTraderGo web and mobile platforms would benefit from an expansion of integrated video content.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

AvaTrade stands out for its rich selection of trading platform options, and for its educational content for beginners – categories where it finished Best in Class. Its range of tradeable markets has nearly doubled year-over-year, and spreads for clients designated as Professional traders in the EU are quite competitive.

About AvaTrade

Founded in 2006, AvaTrade has offices in 11 countries and provides multiple trading platforms for web, desktop, and mobile devices, offering spot forex and forex options and CFDs on numerous asset classes, including cryptocurrencies. AvaTrade has 300,000 registered traders who place more than 3 million trades each month and has executed more than $1.47 trillion in traded value since inception.

AvaTrade holds regulatory licenses in multiple financial hubs across the globe. AvaTrade’s headquarters is in Ireland, where its regulator is the Central Bank of Ireland and is a member of the Investor Compensation Company DAC (ICCL), which provides eligible clients up to EUR 20,000 of maximum reimbursement in the extraordinary event of their broker’s insolvency. While not directly regulated in Canada, AvaTrade caters to clients in the country through its partnership with Friedberg Direct, which required regulatory approval.

How long do AvaTrade withdrawals take?

What is the minimum deposit at AvaTrade?

Is my money safe in AvaTrade?

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.