Overview

Trust score

Tradeable Symbols (Total): 6000

Year Founded: 2016

Publicly Traded (Listed): No

Bank: No

Capital.com is considered average-risk, with an overall Trust Score of 77 out of 99. Capital.com is not publicly traded and does not operate a bank. Capital.com is authorised by two tier-1 regulators (high trust) and one tier-2 regulator (average trust). Capital.com is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail CFD accounts lose money You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Capital.com stands out for its high-quality research, strong educational content, and innovative web platform, making it a great choice for both beginners and experienced traders. Capital.com features competitive pricing and a respectable range of tradeable instruments (including crypto CFDs – though these aren’t available to retail traders in the U.K.), but holds fewer regulatory licenses and offers a narrower range of markets than the top brokers in the industry.

Pros 👍🏻

- High-quality educational articles and courses.

- Newsroom-grade research articles.

- July 2022 average spreads on EUR/USD at 0.6 pips is competitive pricing.

- Good variety of video content for market analysis.

- eQ patented AI trade bias detection system.

- Dedicated Investmate educational app’s game-like design makes learning fun.

- Capital.com offers an extensive range of 490 cryptocurrency CFDs (not available in the U.K. for retail clients), alongside a respectable range of over 6,000 tradeable symbols.

Investment products

What can I trade?

Traders (outside of the U.K.) who are looking to trade crypto CFDs have come to the right place – Capital.com’s range is extensive. Other traders will still find an overall decent symbol offering.

Capital.com offers shares trading and CFDs across a variety of popular asset classes that include over 5,000 shares CFDs, as well as 27 indices CFDs, 138 forex CFDs, 490 crypto CFDs, 29 commodities CFDs, and nearly a dozen thematic indexes. Spread betting is only available for U.K. residents.

Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except for Professional clients).

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 6000 |

| Forex Pairs (Total) | 138 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Fees

What are my trading costs?

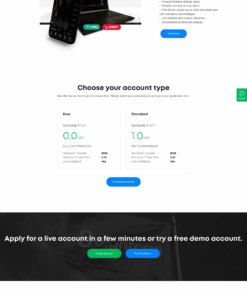

On the whole, the broker’s pricing is about average. But Capital.com boasts competitive spreads as well as account options for both retail traders and professional traders.

Overall, pricing at Capital.com is in line with the industry average. Capital.com offers a universal account option that is available to retail traders, as well as a professional account for those who qualify as elective professional traders (note: professional clients do not receive the same regulatory protection as retail traders).

Trading costs: Capital.com lists 0.6 pips as its dynamic spread for the EUR/USD – which we confirmed to be its average spread for the month of July 2022.

| Feature |  |

| Minimum Initial Deposit | $20 |

| Average Spread EUR/USD – Standard | 0.6 (July 2021) |

| All-in Cost EUR/USD – Active | 0.6 (July 2022) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

Mobile trading apps

Can I trade on the go?

With dedicated mobile apps for both trading and education, Capital.com has you covered whether you’re a beginner or an experienced trader. MetaTrader loyalists can also use the MT4 app.

Apps overview: Capital.com offers three mobile trading apps: its proprietary Trading app, the Investmate app for education, and the MetaTrader 4 (MT4) app – all of which are available for iOS and Android from the Apple App Store and Google Play store, respectively.

Note: For this review I focused on Capital.com’s MT4 and Investmate app. I was unable to install the Trading app due to a country restriction imposed by the developer. For a look at its stock trading app for forex trading, read the review of Capital.com on our sister site, StockBrokers UK.

Ease of use: The MT4 mobile app is offered by nearly all brokers due to its user-friendly interface, and the variety of features that come standard with MetaTrader. The MT4 mobile app makes viewing and managing positions simple and easy, but it doesn’t support algorithmic trading – for that you’ll need the desktop app.

Charting: MT4’s mobile charts are user-friendly and allow for dozens of indicators. Useful functions such as drawing trend lines and changing the time frame are straightforward, and chart tap is as easy as tapping and holding to enable the quick pie menu.

Trading tools: MT4’s economic calendar is powered by its Tradays app, which requires a separate installation that launches from within the MetaTrader app. To access the MetaTrader community features in the app, you’ll need to log into the MQL5 community.

Note: MetaTrader 4 at Capital.com is not available for clients in the U.K.

Other trading platforms

What trading platforms can I use?

Capital.com’s easy-to-use web platform comes loaded with a variety of rich features, making it a great choice. Traders who prefer third-party platforms can still choose to use MetaTrader or TradingView.

Capital.com offers three trading platform suites: MetaTrader 4 for desktop and mobile, Capital.com’s proprietary trading app, and the TradingView web platform – known for its powerful charting. It offers the no-frills MT4 experience straight from the developer, without any noteworthy add-ons that would help Capital.com stand out from the best MetaTrader brokers.

Platforms overview:

The MetaTrader 4 suite is available at Capital.com for macOS and Windows operating systems, alongside the web version that can be accessed via any modern browser. Capital.com’s proprietary platform is an easy-to-use web-based trading platform, that comes loaded with a great balance of features.

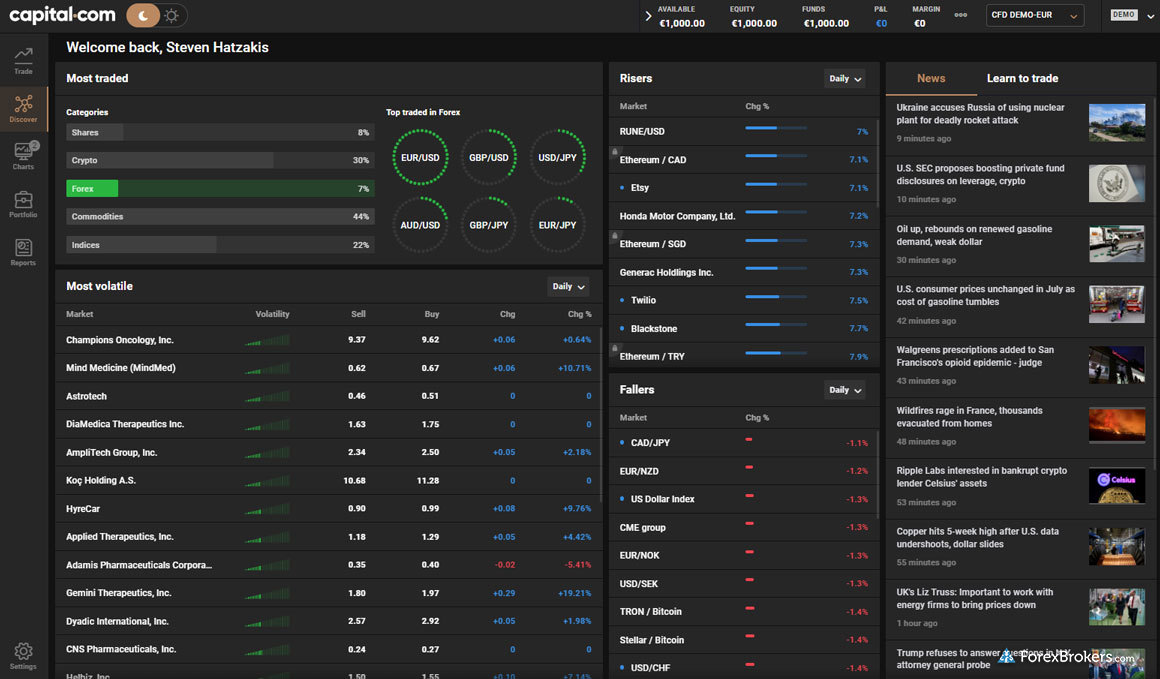

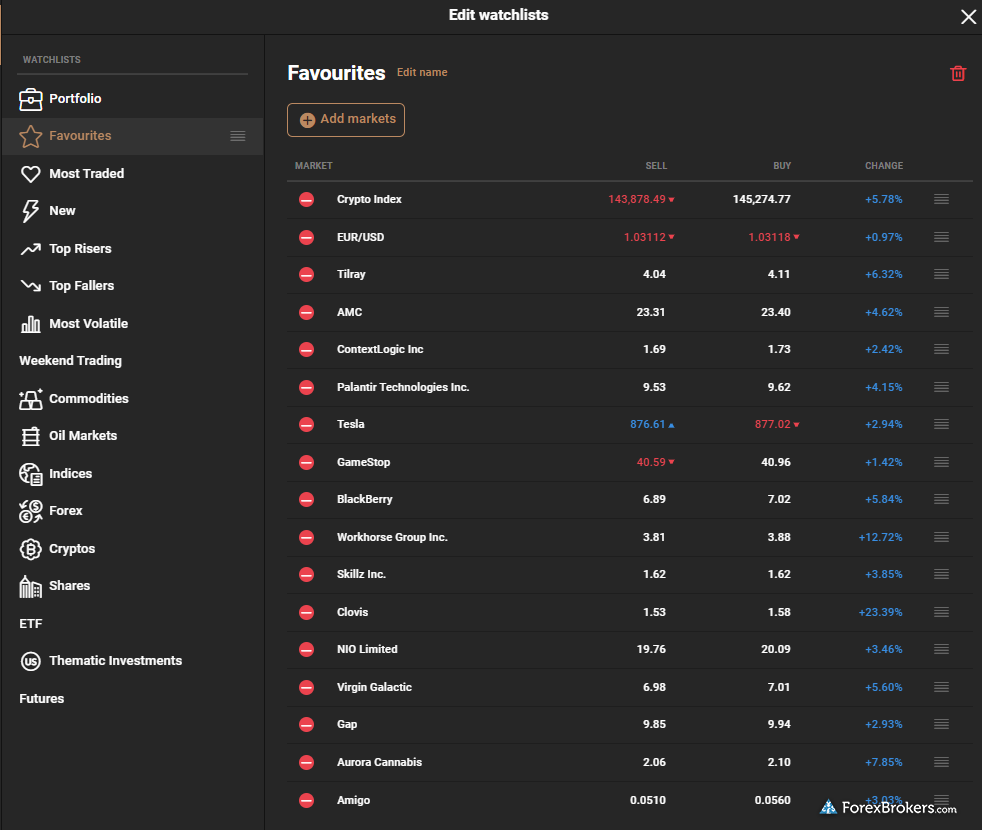

Discover Tab

I found the discover tab to be useful for taking a broad view of the market – to see the most traded, most volatile, and the risers and fallers at a glance. There are also pre-defined watchlists that can be customized and at least ten thematic indices – from e-sports to electric cars to cryptocurrencies.

Overall, the Capital.com web platform is a great choice for nearly all types of traders, balancing ease of use with a variety of rich features. It ranks closely behind platform offerings from the best forex brokers in this category.

Charting: The MetaTrader platform suite is known for its robust easy-to-use charts. Zooming in and out and rearranging windows and tabs is a breeze on MT4. It also supports the ability to drag and drop from the default list of nearly 50 indicators. The Capital.com web platform stands out in its own right with rich features and a variety of tools, such as pre-defined watchlists that act as screeners to scan the market, along with sentiment data and integrated research from Trading Central.

Trading Central: The full suite of Trading Central modules is integrated into the Capital.com web trading platform, including Analyst Views, Featured Ideas, and TC Market Buzz.

Note: MetaTrader 4 at Capital.com is not available for clients in the U.K.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | No |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 75 |

| Charting – Drawing Tools (Total) | 18 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 6 |

Note: MetaTrader 4 at Capital.com is not available for clients in the U.K.

Market research

Can I stay informed about the markets?

Capital.com’s well-organized, polished research content is well-written and often includes charts and analysis. The broker also offers themed video playlists and full integration of Trading Central modules.

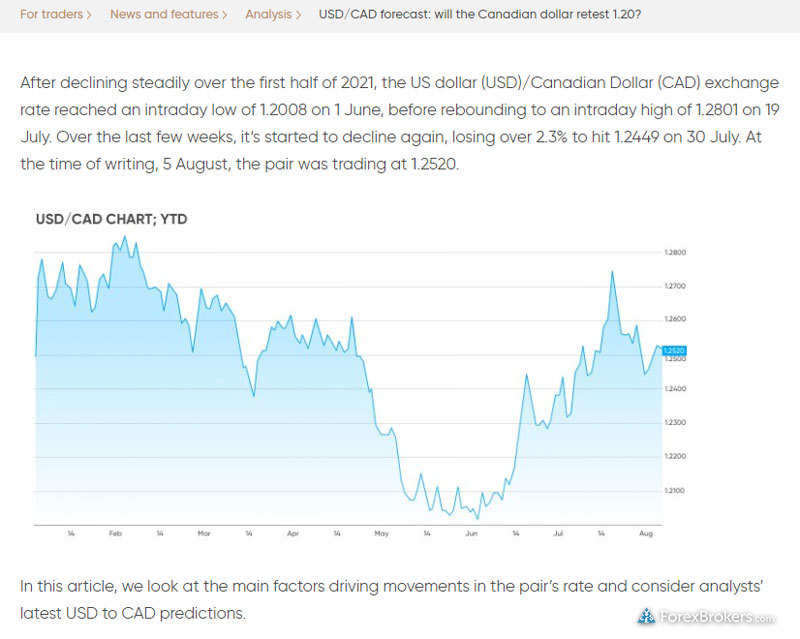

Capital.com’s market commentary is well-organized, offering various theme-specific playlists on YouTube and on its website. It also offers detailed articles under its news and analysis section which I found to be rich with information. From technical analysis to commentary about economic fundamental data points, Capital.com’s robust research offering exceeds what I’d expect to find with the average broker.

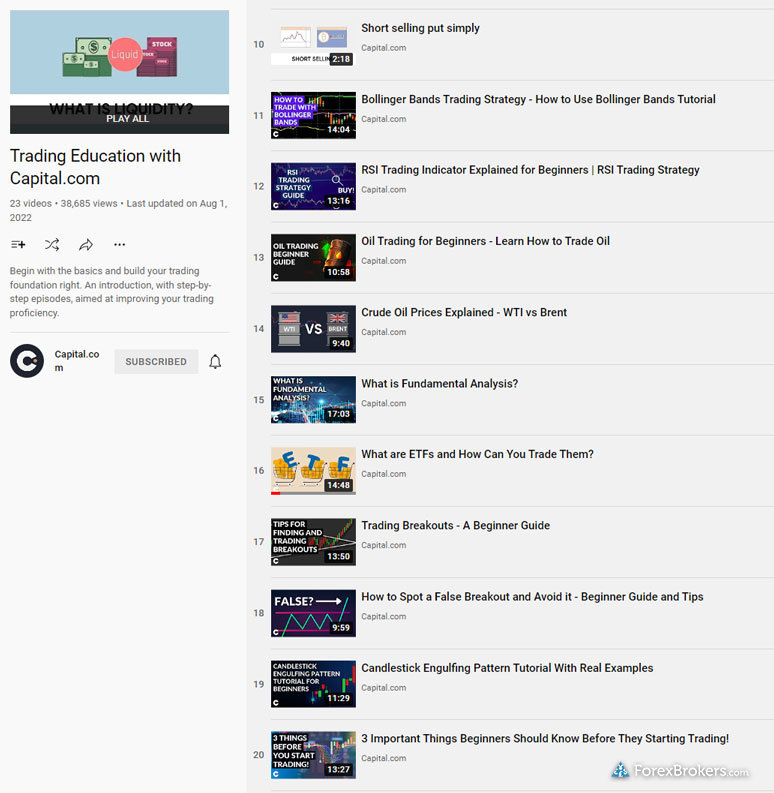

Research overview: Capital.com offers research alongside its educational content from within the Capital.com TV section of its website where videos are arranged into playlists.

Market news and analysis: The research videos found in the Market Outlooks section are well made, including the weekly outlook and content for specific symbols. Likewise, the articles that Capital.com publishes on its website are well-written, link to sources, and often include charts and analysis – comparable to what you would find in a newsroom publication. Overall, I was impressed.

Trading Central: The integration of Trading Central’s full suite of modules into Capital.com’s web platform, helps further complement its overall research offering.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

Education

Can I learn about trading and investing?

Capital.com’s Investmate app is exclusively dedicated to education for traders and investors, and provides access to a comprehensive lesson program that tests your financial knowledge.

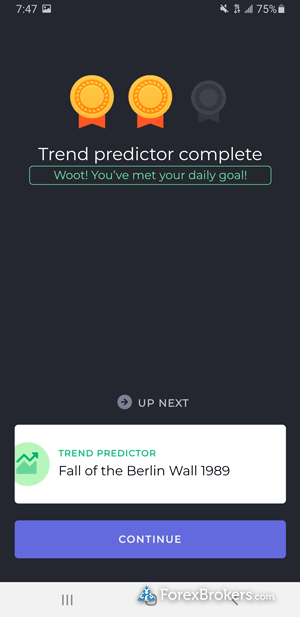

Capital.com has a solid array of educational materials that includes articles, videos, and a comprehensive lesson program, making it an excellent choice for beginners. This educational program includes 28 lessons spread across five courses, and ends with a final test designed to gauge your progress and your financial knowledge. I found its Investmate app to be even more impressive. It adopts a style influenced by gaming, which allows you to learn at your own pace while tracking your progress.

Learning center: Capital.com has at least 72 educational videos on its YouTube channel – some of which are embedded in its web platform. It also features ten written guides that I found to be informative and rich with detail, that focus on individual topics such as CFD trading and trading psychology. Several of these guides have sub-articles that dive into even greater detail, explaining various terms and concepts beyond what you would find in an investor glossary. Overall, Capital.com’s strong educational offering is right up there with the best brokers in this category.

Investmate: Several brokers, such as IG, have created apps strictly dedicated to educating traders, and Investmate is Capital.com’s answer to this industry trend. Investmate is a great example of a mobile app that makes education its prime focus, while still ranking highly for ease of use and providing a smooth user experience.

Room for improvement: Capital.com’s educational content would benefit from an expansion of its lesson program. Including more content and offering the ability to organize that content by experience level would further elevate this already-impressive educational tool.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

As a relative newcomer, Capital.com has proven it can deliver high-quality research and educational content, along with an excellent web trading platform that offers a decent range of markets.

Expanding its list of licenses in more tier-one jurisdictions will help win more trust, and increasing its range of markets will bring it closer to matching up with the best forex and CFD brokers. Overall, Capital.com finished best in class for 2022 in the beginners category, as well as for its offering of crypto CFDs (not available in the U.K.).

About Capital.com

Founded in 2016, the Capital.com brand caters to more than 500,000 registered clients for Capital.com group, and has group entities authorised and regulated locally in the U.K. by the Financial Conduct Authority (FCA) and in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), in Australia by the Australia Securities and Investment Commission (ASIC), in the Seychelles by the Financial Services Authority (FSA) of Seychelles, and in Belarus by the National Bank of Belarus.

How does Capital.com make money?

Capital.com makes money in a variety of ways; to understand how it makes money, you have to examine its execution methods. As per its order execution policy, Capital.com offers both market maker execution and agency execution (depending on the markets you are trading). Under the market maker model, Capital.com earns a portion of the bid/ask spreads that you pay to buy/sell on its platforms. Conversely, under the agency execution model, Capital.com acts as your agent by sending your order to another market maker, who is sharing a portion of the spreads back with Capital.com. Alternatively, with agency execution, Capital.com may charge a commission depending on the asset class you are trading.

Tip: Just because a broker offers commission-free trading or low spreads doesn’t mean it is not making any money. All brokers are either market makers, acting as an agent and sending orders to another market-maker, or doing a little bit of both (i.e. a hybrid model), which will determine how they make money from client trading volumes.

Can you withdraw from Capital.com?

Yes, but keep in mind that the method you originally used to deposit funds at Capital.com may affect what options are available to you for withdrawing funds. The country from which you deposited your funds can also be a factor; if you send funds from a bank account in one country, you’ll have to withdraw funds back to that same country and to that same account (or another bank account under your name, after verifying ownership). These factors can also affect the timing of your withdrawal, which can range from less than 24 hours to as much as five business days (not including any potential delays from your bank or provider on the receiving side).

These kinds of restrictions and limitations (when withdrawing funds) are commonplace at all legitimate brokerages that are regulated in top-tier jurisdictions, and are put in place – in part – to prevent money laundering.

The following payment methods are supported at Capital.com:

- Visa or Mastercard.

- Apple Pay.

- Bank transfer (wire or SEPA transfer).

- Neteller (Maximum EUR 2,000).

- Skrill (Maximum EUR 2,000).

- Google Pay (Maximum EUR 2,000).

- PayPal (Maximum EUR 2,000) – As with any broker, withdrawal requests can be rejected under certain circumstances, such as when trying to withdraw to an unsupported payment provider, by exceeding the per-transaction volume limit, or by failing to provide relevant supporting documents for your withdrawal method. A request can also be rejected if you attempt to withdraw too little (withdrawals must be greater than 50 USD, or your currency equivalent, at Capital.com).

Is Capital.com legal in the US?

Capital.com cannot currently accept U.S. clients, because it doesn’t yet hold the required U.S. license (as a Forex Dealer Member with the CFTC), despite being authorized and regulated in other jurisdictions in which the broker can accept non-U.S. residents. If you are a U.S. resident, you must only trade with a broker that is licensed in the U.S. Check out our international search tool to find out about your specific country of residence and whether Capital.com can legally accept your account.

2022 Review Methodology

For our 2022 Seven Broker Riview we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.