Overview

Top Takeaways for 2021

- Founded in 2001, easyMarkets is regulated in one tier-1 jurisdiction and one tier-2 jurisdiction, making it a safe broker (average-risk) for forex and CFDs trading.

- easyMarkets is best known for its proprietary web-based platform that is easy to use and offers two beginner-friendly features: dealCancellation and Freeze Rate. Low-points in the easyMarkets lineup include a lack of extensive forex market research tools, a limited offering of just 256 tradeable instruments, and a mediocre mobile app.

- Despite offering free guaranteed stop-loss orders (GSLO), we do not recommend the easyMarkets MetaTrader 4 (MT4) offering. With MT4, easyMarkets excludes market headlines in desktop and does not offer the browser-based version.

Overall Summary

Please Note: easyMarkets was not included in our last annual review. As a result, this broker’s ratings may be outdated. Read our best forex brokers guide for a breakdown of the top rated forex and CFDs brokers.

| Feature |  |

| Overall Rating | |

| Trust Score | 84 |

| Offering of Investments | |

| Commissions & Fees | |

| Platform & Tools | |

| Research | |

| Mobile Trading | |

| Education |

Is easyMarkets Safe?

easyMarkets is considered average-risk, with an overall Trust Score of 84 out of 99. easyMarkets is not publicly traded and does not operate a bank. easyMarkets is authorised by one tier-1 regulator (high trust), one tier-2 regulator (average trust), and one tier-3 regulators (low trust). easyMarkets is authorised by the following tier-1 regulator: Australian Securities & Investment Commission (ASIC). Learn more about Trust Score.

| Feature |  |

| Year Founded | 2001 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 1 |

Offering of Investments

The following table summarizes the different investment products available to easyMarkets clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s UK entity, nor to UK residents.

| Feature |  |

| Overall Rating | |

| Trust Score | 84 |

| Offering of Investments | |

| Commissions & Fees | |

| Platform & Tools | |

| Research | |

| Mobile Trading |

Commissions and Fees

Account types: easyMarkets offers three account types for which trading costs (spreads + any commissions) vary, and spreads are fixed (not variable) across web platform, MetaTrader4 (MT4), and a VIP account.

Minimum and Spreads: The most competitive pricing easyMarkets offers is on its VIP account, which requires a $2,500 deposit ($100 for EU and UK residents), as well as its web platform, which requires a $250 deposit. Both accounts offer fixed spreads of 0.9 pips on the EUR/USD on the easyMarkets platform, as well as when using the MT4 account.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 199 |

| Forex Pairs (Total) | 62 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

Platforms and Tools

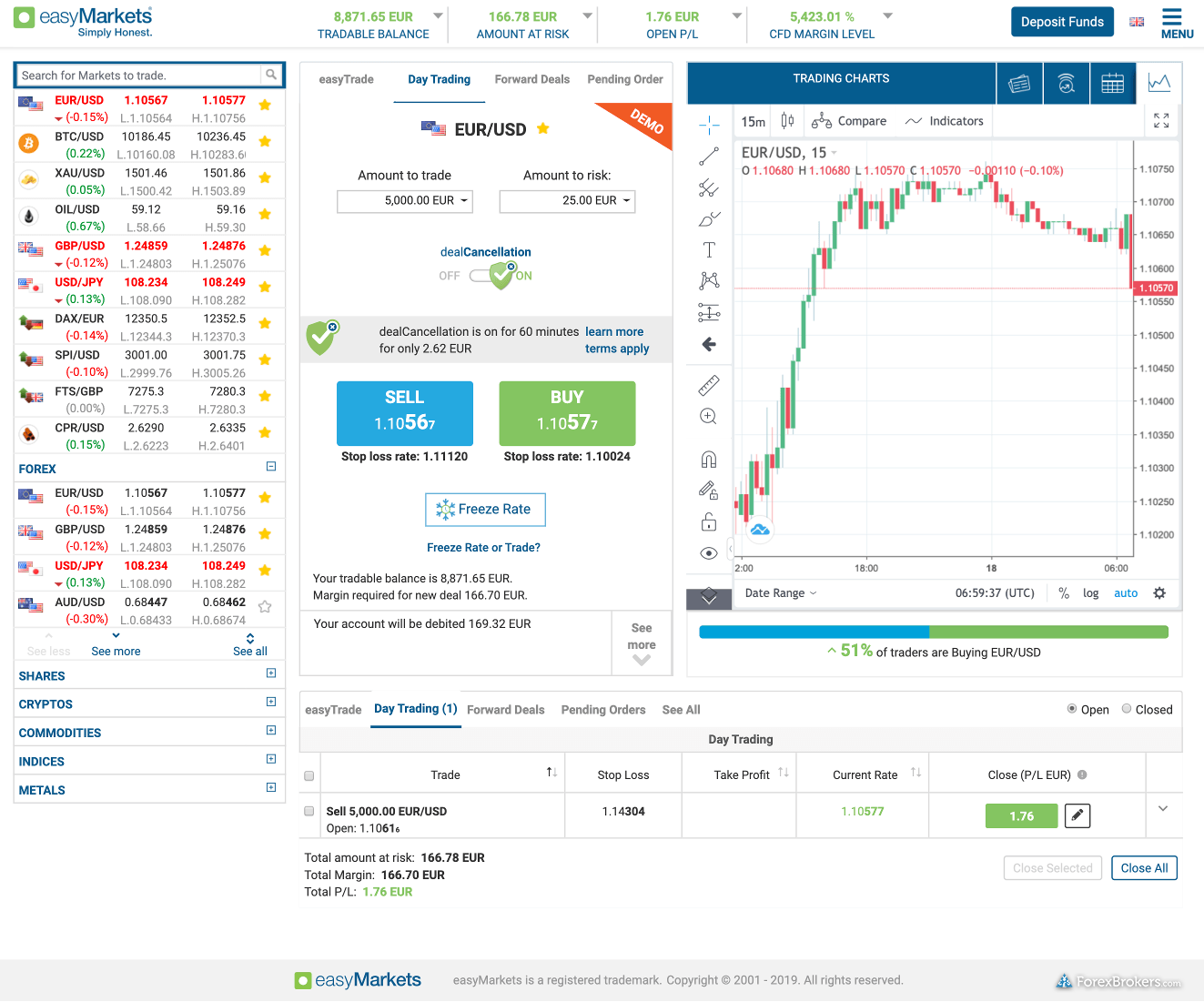

easyMarkets offers two platforms, its own proprietary HTML5 web-based platform and MetaTrader 4 (MT4).

Beyond a watch list (favorites list), news, charts, sentiment indicator, and a few other tools, the easyMarkets trading platform is otherwise light. The clean and simplicity focused platform design does well in keeping users focused on trading, data-namehough it will not be enough to satisfy more demanding traders.

Trading tools: Two unique tools offered through the easyMarkets platform include dealCancellation and Freeze Rate. For a small fee, the dealCancellation feature gives you a specific amount of time (up to a maximum of six hours)to have the option to undo your trade and reclaim your losses. Meanwhile, the Freeze Rate button allows you to “freeze” a quote for three seconds.

Both tools appear attractive, but clearly, easyMarkets advertises them for a reason, which means that overall, they must be profitable for easyMarkets. Also, in support of less experienced traders, easyMarkets platform offer guaranteed stop-loss orders (GSLO) for free, compared to most brokers who charge a small premium.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

Research

easyMarkets integrates several research resources into its trading platforms, including a sentiment indicator, economic news calendar, streaming news headlines from FxWirePro, as well as trading signals from Trading Central for live account holders.

Overall, despite a broad selection of features, easyMarkets’ research offering is just a touch above the bare minimum industry standard.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

Mobile Trading

easyMarkets offers its proprietary mobile app, as well as the MetaTrader 4 (MT4) mobile app. Looking at the easyMarkets mobile app, it offers a clean design that mostly mirrors its web-based counterpart, syncing watch lists included.

Charting is powered by Trading View in the mobile app, with the same 81 indicators that the web version of the platform has. Overall, I found it to be simple and basic yet falls behind the best mobile trading apps in our review, in terms of depth of features and tools.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | No |

| Watchlists – Total Fields | 6 |

| Watchlist Syncing | Yes |

| Charting – Indicators / Studies (Total) | (default MT4) |

| Charting – Drawing Tools (Total) | (default MT4) |

Customer Service

For our 2018 Forex Review, 129 customer service phone tests were conducted over three months. The data collected is institutional grade. On average, three questions were asked for each test. To score each test, the tests were divided into three separate groups and scores were given for the time taken to connect with each support representative and the ability of each representative to professionally (and thoroughly) answer each question. A Net Promoter Score was also given for the overall experience.

Results

- Average Connection Time: <1 minute

- Average Net Promoter Score: 6.66 / 10

- Average Professionalism Score: 7.1 / 10

- Overall Score: 7.3 / 10

- Ranking: 10th (43 brokers)

Final Thoughts

With 256 symbols to trade, including over-the-counter FX options and forwards on 28 pairs, easyMarkets offers a light multi-asset brokerage solution. Tradeable assets aside, easyMarkets does provide its proprietary trading platform, alongside MT4, which helps it stand out from other MT4-only brokers. Also, easyMarkets finished Best in Class for Beginners in 2020, thanks to its user-friendly platform interface.

MetaTrader4 is also an option at easyMarkets given no difference in pricing between the broker’s web platform. That said, easyMarkets’ flagship web platform and VIP accounts struggle to compete with the best forex brokers in our annual review.

About easyMarkets

easyMarkets (formerly easyForex) was founded in 2001 and is an early pioneer in offering retail forex trading. The broker obtained regulatory status with the Australian Securities and Exchange Commission (ASIC) in 2005 under Easy Markets Pty Ltd, and in 2007 with the Cyprus Securities and Exchange Commission (CySEC) under Easy Forex Trading Ltd.

2022 Review Methodology

For our 2022 Seven Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.