Overview

Trust score

Tradeable Symbols (Total): 326

Year Founded:

Publicly Traded (Listed):

Bank:

Start trading with Eightcap today with spreads from 0.0 pips* and fast execution.

Open an account and gain exposure to more than 1000 financial instruments on our award-winning platforms**.

Pros 👍🏻

- You can deposit and withdraw funds via a debit/credit card, bank transfer and cryptocurrency;

- Narrow spreads both on Raw and Standard accounts;

- Access to trading on МТ4, МТ5 and WebTrader platforms;

- Wide selection of assets – over 1,000 CFDs;

- High leverage of up to 1:500 on major currencies.

Cons 👎🏻

- Narrow range of CFD symbols, and only 45 forex pairs available.

- Eightcap’s research content lacks depth, variety, and consistency.

- Educational resources lack the ability to filter content by experience level, and would benefit from the inclusion of a progress-tracking feature.

- Educational videos are sparse compared to what the best forex brokers for beginners offer.

- The range of markets, accounts, and execution methods available at Eightcap simply can’t compete with the best MetaTrader brokers.

Offering of investments

Eightcap’s 45 forex pairs and roughly a dozen CFDs put its offering of investments below the industry average. The following table summarizes the different investment products available to Eightcap clients.

Cryptocurrency: Cryptocurrency trading is available at Eightcap through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 326 |

| Forex Pairs (Total) | 45 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

Commissions and fees

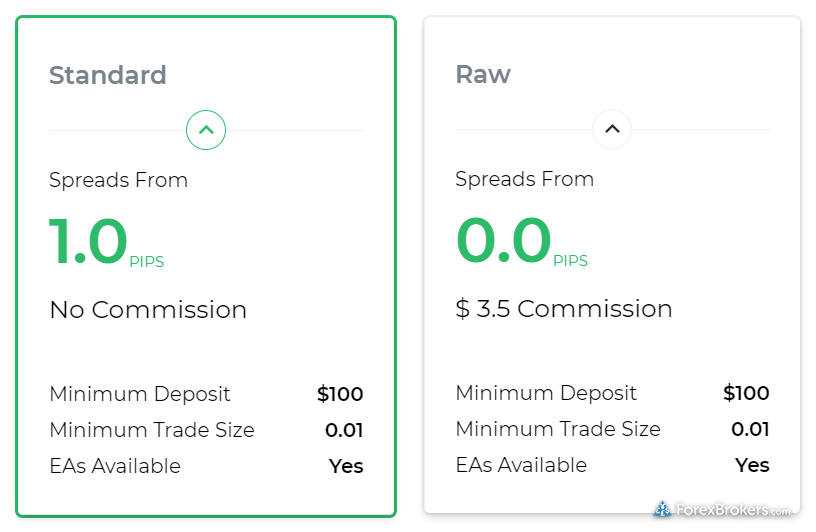

Eightcap offers two account types across its global entities, including those in Australia and Vanuatu. The commissions and fees you pay will depend on whether you choose the commission-based Raw account or the spread-only Standard account.

Eightcap lists an average spread of 0.06 pips for its commission-based Raw account. However, after factoring in the per-side commission of $3.50 per trade, the all-in cost amounts to roughly 0.76 pips – coming in just under the industry average of 0.8 pips. It’s worth noting that Eightcap did not provide a date range for its published average spread data.

Overall, Eightcap is slightly more expensive than the lowest-cost forex brokers.

| Feature |  |

| Minimum Initial Deposit | $100 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | 0.76 |

| Active Trader or VIP Discounts | No |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

With no proprietary mobile app available, Eightcap simply can’t compete with industry leaders like IG and Saxo Bank. For our top picks among trading apps, read our guide to best forex trading apps.

Apps overview: As Eightcap is a MetaTrader-only broker, iOS and Android versions of the MT5 app come standard and are both available for download from the Apple App Store and Google Play store, respectively.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

Other trading platforms

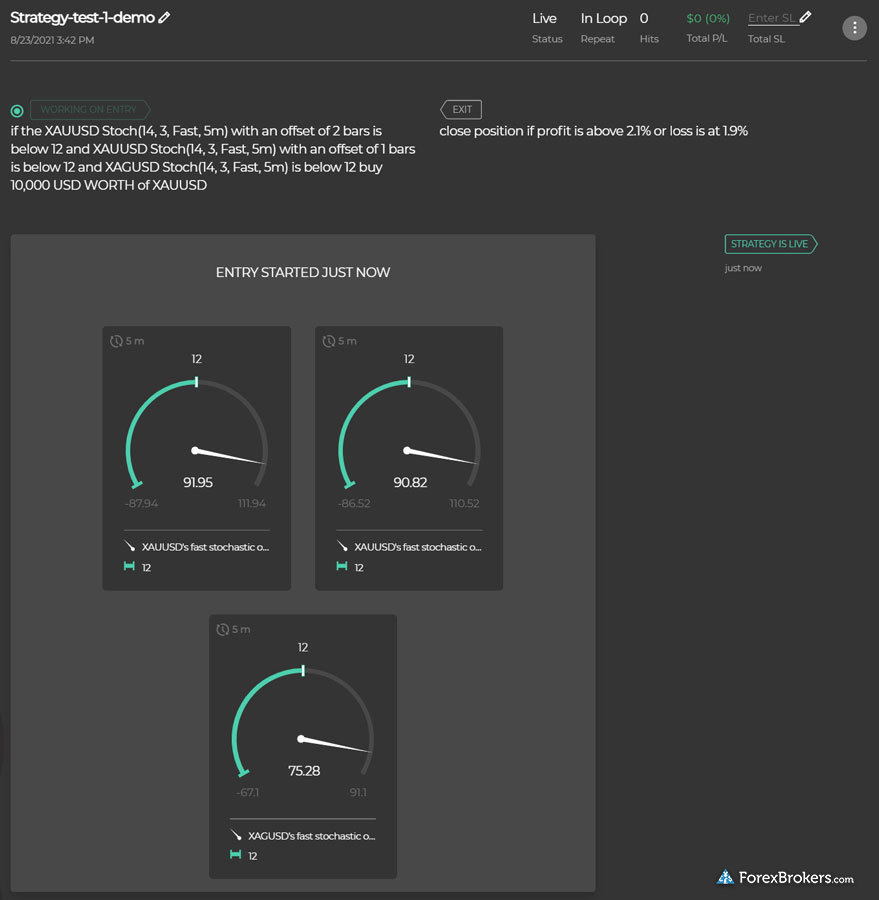

Eightcap offers a suite of plug-ins from FX Blue that enhance the standard MetaTrader platform suite. It also supports integration with Capitalise.ai, allowing algorithmic trading within your MetaTrader 4 (MT4) account. With a variety of extra features that enhance the standard MetaTrader experience, Eightcap has inched closer towards offering what the best MetaTrader brokers provide, but did not finish best in class in 2022.

Platforms overview: Eightcap is a MetaTrader-only broker offering the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform suite from MetaQuotes Software Corporation. Eightcap also recently introduced the ability for clients to connect their accounts to TradingView, a popular third-party charting platform.

Trading tools: In addition to plug-ins from FX Blue, Eightcap provides access to Capitalise.ai, a third-party platform for coding automated trading strategies in plain English – without the need to program any code.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

Market research

Eightcap produces a modest variety of research content that includes daily updates in both written and video format – however, its research offering doesn’t stack up against what the best brokers offer.

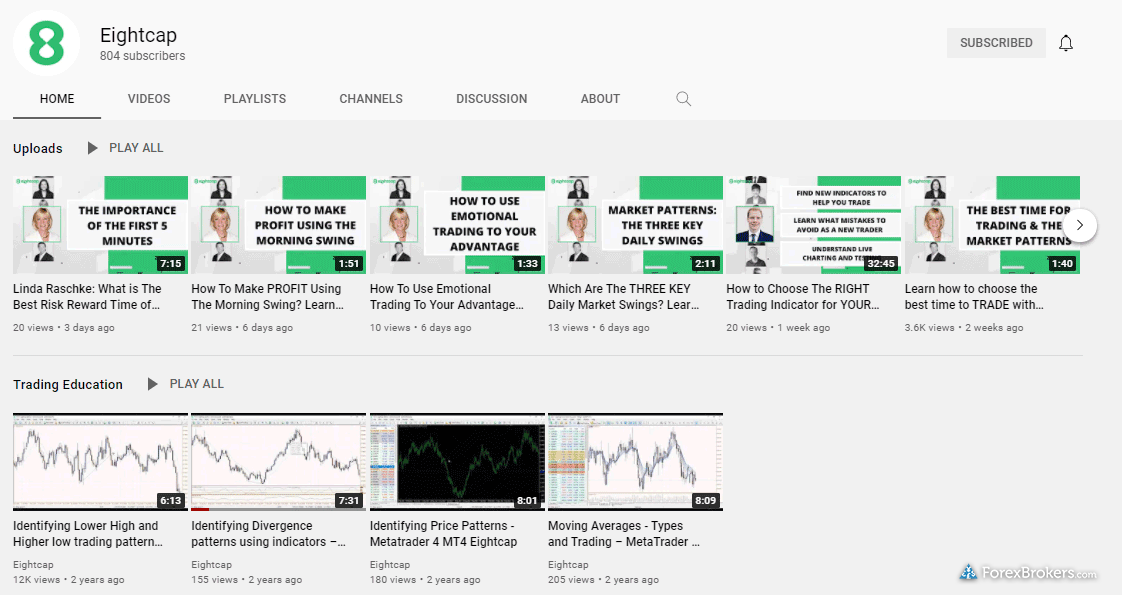

Research overview: Eightcap’s research primarily takes the form of daily written updates from its in-house staff – such as its Trading Week Ahead series – accompanied by the occasional video posted to the firm’s YouTube channel, which hosts its Market Update video series.

Market news and analysis: Expanding the range of research by integrating third-party research tools and content (such as Autochartist and Trading Central) would help lift Eightcap’s ranking in this category.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | No |

Education

Eightcap’s educational offering delivers a wide variety of written articles, but only a limited selection of videos. Some of the best brokers in this category offer lesson programs, complete with quizzes and progress tracking – features that are absent at Eightcap.

Learning center: Eightcap offers just a dozen educational videos, and a handful of archived webinars, such as its TraderFest series which covers CFDs and forex. These videos are archived on its YouTube channel and organized by playlist. The selection of written educational content articles has improved, and includes at least 74 articles covering fundamentals and trading strategies.

Room for improvement: Expanding the selection of educational videos and organizing articles by experience level would help balance Eightcap’s overall educational offering.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

By offering various platform plug-ins and granting access to third-party tools like Capitalise.ai, Eightcap has taken strides to improve on the standard MetaTrader platform suite. Eightcap also offers more cryptocurrency pairs than nearly every other broker we reviewed – a feature it launched in 2021.

Significant hurdles remain for Eightcap to become a top MetaTrader Broker, such as its narrow range of available markets and lack of a proprietary mobile app.

About Eightcap

Eightcap was established in 2009 in Melbourne, Australia, and holds an Australian Financial Service License (AFSL) with the Australian Securities & Investment Commission (ASIC). Eightcap’s U.K. entity, Eightcap Group Ltd, is authorised and regulated by the Financial Conduct Authority (FCA), and its EU entity is authorised by the Cyprus Securities and Exchange Commission (CySEC). Lastly, in the offshore island nation of Vanuatu, Eightcap Global Pty Ltd holds regulatory status with the Vanuatu Financial Services Commission (VFSC) since December 2019.

2022 Review Methodology

For our 2022 Seven Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.