Overview

Trust score

Tradeable Symbols (Total): 3458

Year Founded: 2007

Publicly Traded (Listed): No

Bank: No

eToro được coi là có rủi ro thấp, với Điểm tin cậy tổng thể là 93 trên 99. eToro không được giao dịch công khai, không điều hành ngân hàng và được ủy quyền bởi hai cơ quan quản lý cấp 1 (độ tin cậy cao), một cơ quan quản lý cấp 2 ( độ tin cậy trung bình) và không có cơ quan quản lý cấp 3 nào (độ tin cậy thấp). eToro được ủy quyền bởi các cơ quan quản lý cấp 1 sau: Ủy ban Chứng khoán & Đầu tư Úc (ASIC) và Cơ quan Quản lý Tài chính (FCA) . Tìm hiểu thêm về Điểm tin cậy .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail CFD accounts lose money You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro is a winner for its easy-to-use copy-trading platform, where traders can copy the trades of experienced investors – or receive exclusive perks for sharing their own trading strategies.

With over 3,000 tradeable symbols, including CFDs, forex, and exchange-traded securities, eToro offers a comprehensive – albeit slightly pricey – trading experience.

Pros 👍🏻

- eToro was founded in 2007 and is regulated in two tier-1 jurisdictions and one tier-2 jurisdiction, making it a safe broker (low-risk) for trading forex and CFDs.

- eToro is excellent for social copy trading and cryptocurrency trading and is our top pick for both categories in 2022.

- Fantastic for ease of use thanks to its user-friendly web platform and the eToro mobile app that is great for casual and beginner investors.

- eToro continues to expand its available range of markets as a multi-asset broker with over 3,000 symbols available.

- Offers indemnity insurance of up to EUR 1 million per client in the EU, the U.K., and Australia.

- VIP-style perks are available for club members and popular investors that reach higher tier status.

Cons 👎🏻

- Trading forex and CFDs at eToro is slightly pricier than most of its competitors, despite recently cutting spreads and introducing zero-dollar commissions for U.S. stock trading.

- eToro’s range of traditional research materials and tools is limited compared to its peers.

- Automated (algorithmic) trading strategies are not supported at eToro.

- Mandatory stop-loss and take-profit may hinder certain trading strategies.

- Trading Central research and tools are only available to certain eToro Club members who have reached higher Club tiers.

Offering of investments

eToro offers a total of 3458 tradeable symbols, which is following table summarizes the different investment products available to eToro clients.

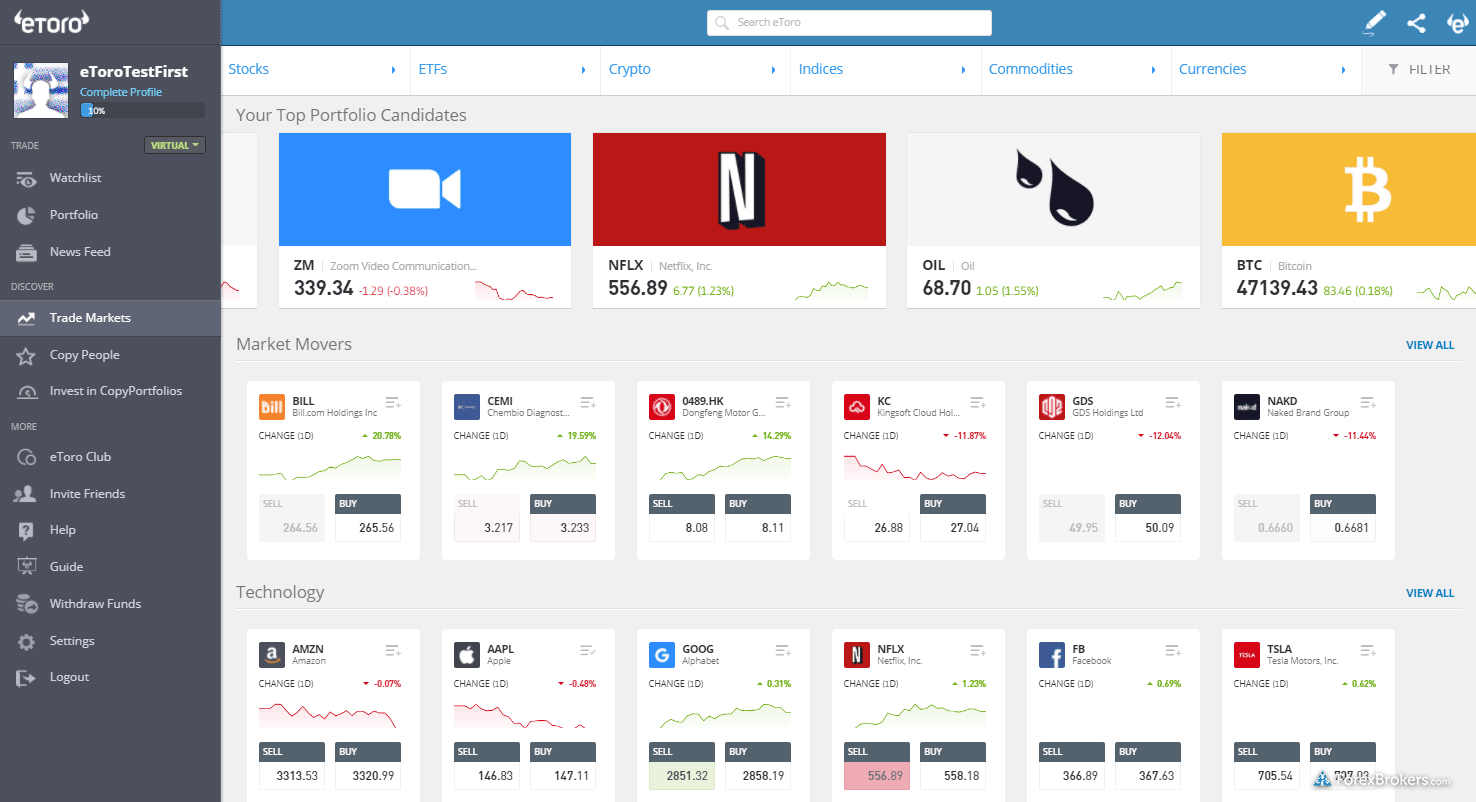

Usability: As a multi-asset broker, eToro goes above and beyond to make the experience smooth for traders. For example, eToro provides the ability to select between trading CFDs and the underlying assets directly from the trade-ticket window. A subtle feature, but very useful.

Cryptocurrency: Cryptocurrency trading is available at eToro through CFDs and through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to residents of the U.K. or the Netherlands. In addition, cryptocurrency trading at eToro is not available in Russia.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 3458 |

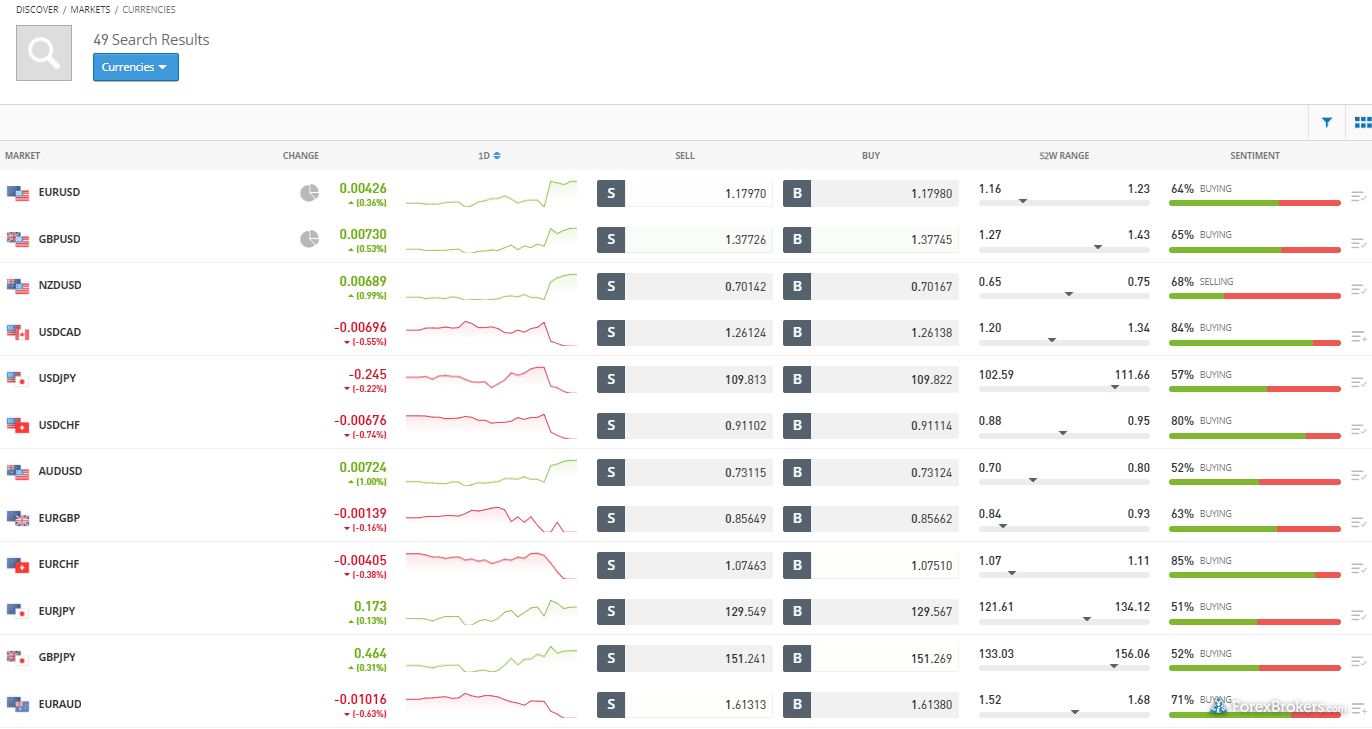

| Forex Pairs (Total) | 49 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | Yes |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

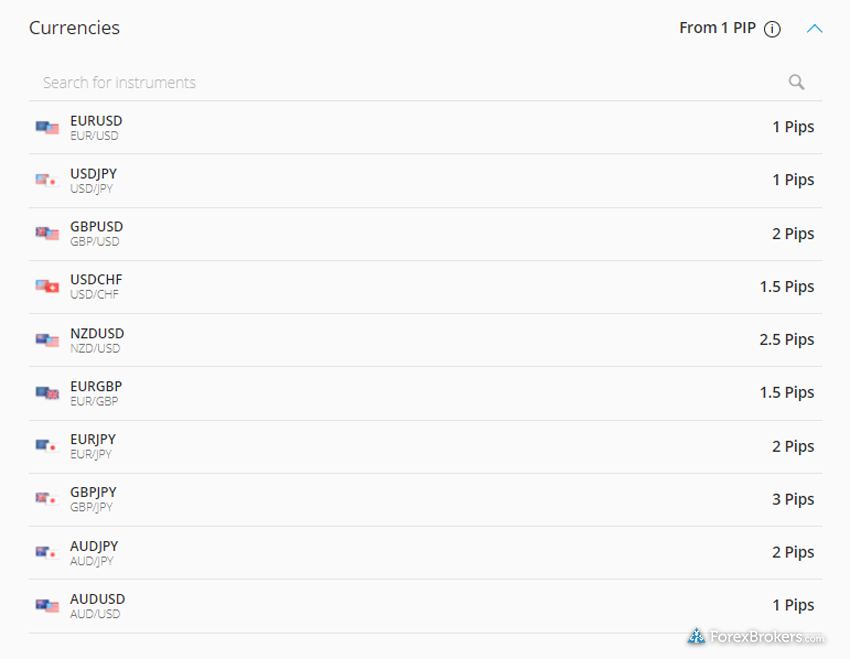

eToro is a market-maker broker and lists a typical variable spread of 1 pip on the EUR/USD, which is slightly higher than the industry average. Considering its trading fees and retail traders don’t choose eToro for its spreads, but rather for its social copy trading platform capabilities.

VIP accounts: eToro offers a VIP club (called eToro Club) with five tiers of membership that range from Silver to Diamond. These tiers are for traders who maintain balances between $5,000-$250,000 and feature varying benefits depending on the level of membership. VIP perks range from access to Trading Central, to discounted withdrawal and deposit fees for a dedicated account manager – among other VIP-style benefits.

Popular Investor program: eToro’s Popular Investor program (for traders who allow other investors to copy their strategy) has four levels – ranging from Cadet to Elite – where traders can become eligible for various perks. To qualify for the Cadet tier you must have more than $1,000 in account equity, attract $500 in customer assets that copy your strategy, and maintain a risk score below 7 for at least two months. Benefits available to Popular Investors include spread rebates, monthly payments, and even a management fee for those who reach elite status.

Cryptocurrency trading: Overall, eToro’s pricing is close to the industry average for trading physical cryptocurrency. For each buy and sell position, users pay a single fixed fee of 1% (on top of the spread) on each side of the trade (both when opening a closing a position).

Exchange-Traded Securities: In addition to trading CFD shares, eToro also offers zero-dollar commission for U.S. stock trading (not available to U.S. investors) and supports fractional shares. To learn more, see our UK.StockBrokers.com review of eToro.

| Feature |  |

| Minimum Initial Deposit | $10-$10,000 |

| Average Spread EUR/USD – Standard | 1 (August 2021) |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

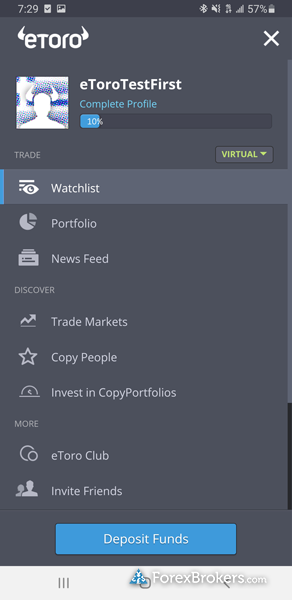

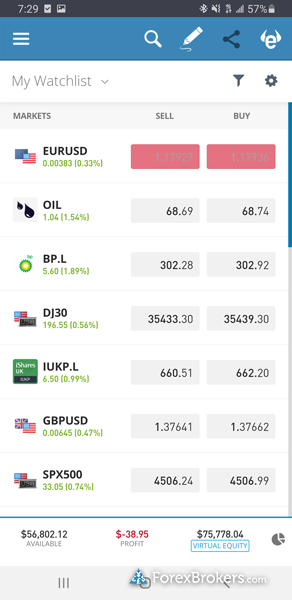

Overall, eToro offers an excellent mobile experience. Besides the ease-of-use factor is high, and eToro delivers nearly all the same features across both its web platform and its mobile app, which multi-device clients will appreciate.

Apps overview: eToro provides two mobile apps: both the eToro app and eToro Money for crypto and money transfers. Both apps are available on Google Play for Android, and Apple App Store for iOS devices.

Check out our video walkthrough of eToro’s mobile app:

Ease of use: Testing on Android, I found that the eToro mobile app maintains the look and feel of the web version, including useful functions such as dark and light mode themes, and synced watchlists that help to unify the platform experience across devices.

Charting: Like the rest of the mobile app, the charts are responsive and closely match the web platform experience, though just five indicators are present compared to 67 on the web. But Drawing tools are missing from the app entirely and would be a welcome enhancement to an otherwise cleanly-designed and well-integrated mobile app.

Cryptocurrency wallet: The eToro wallet, known as eToro Money, is a separate mobile app where users can deposit and withdraw money and actual cryptocurrencies. As a result crypto assets are held by eToroX, which acts as the custodian of your cryptocurrency private keys. The eToro Money Wallet closely resembles the look and feel of the eToro mobile app, and includes support for social trading.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 6 |

| Watchlist Syncing | Yes |

| Charting – Indicators / Studies (Total) | 66 |

| Charting – Drawing Tools (Total) | 13 |

Other trading platforms

eToro’s main innovation is merging self-directed trading and copy trading under a unified trading experience. It is a winning combination. See our Best FX Brokers for Copy Trading.

Platforms overview: Ease of use and simplicity of design are at the heart of the eToro web platform experience, and carrying out basic operations is straightforward and painless. Traders gain access to functions such as the ability to create watchlists, as well as the option to add instruments simply by searching available markets. These design qualities helped eToro rank Best in Class in the Ease of Use and Beginners categories in 2022.

Check out our video walkthrough of eToro’s well-designed web platform:

Charting: The full functionality of eToro’s charting truly comes alive when you launch its ProCharts setting. ProCharts comes with 66 indicators, 13 drawing tools and the ability to save and choose from predefined layouts.

Trading tools: Another innovative tool from eToro is its CopyPortfolios feature, which groups traders into single funds for copy trading. CopyPortfolios help to bridge the gap for investors who want to use eToro on a passive basis, as they can create a portfolio based entirely on one or more CopyPortfolios. On the other hand, self-directed traders can also use CopyPortfolios to diversify their trading, making it a potentially useful tool for all eToro clients.

Cryptocurrency tools: eToro users can find crypto-trading ideas and copy other individuals or groups of traders across 108 supported cryptocurrency pairs. For investors looking to withdraw underlying crypto assets from their eToro account, eToroX offers the eToro Mobile wallet app. This app acts as a custodian with a multi-signature scheme and closely mirrors the brand’s forex mobile app.

Copy trading structure: Fully automated trading systems (i.e. algorithmic trading) such as those supported on MetaTrader are not permitted at eToro. Therefore, when you copy another trader on eToro, you can be sure they are placing each trade manually. This is quite useful to know, as many other social trading platforms that aggregate the performance of traders usually permit discretionary (manual) trading as well as automated strategies.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | No |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 66 |

| Charting – Drawing Tools (Total) | 13 |

| Charting – Trade From Chart | No |

| Watchlists – Total Fields | 6 |

Market research

Overall, eToro’s research is competitive and continues to improve year-over-year – but is still not award-winning. For example, there are no daily video updates with market analysis, and certain features are locked until specific account tiers are reached.

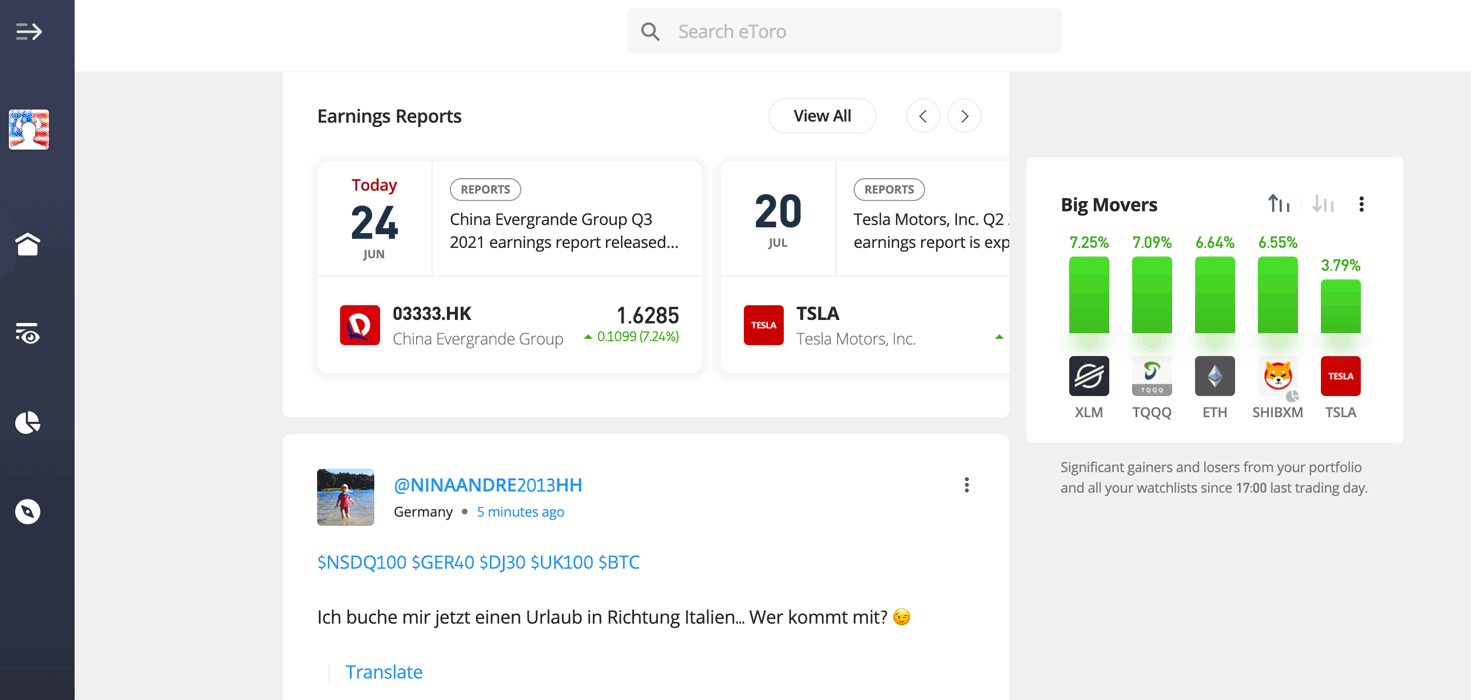

Research overview: eToro offers a standard economic calendar, an earnings reports calendar, news headlines, daily market analysis series, and podcasts. That said, several of these features are not directly integrated into the eToro platform. Trading Central is also available, but is not offered to all clients – it’s reserved for eToro club members that have reached a specific tier status. There are also research reports for stocks available to funded account holders.

Market news and analysis: eToro does an excellent job incorporating fundamental analysis into its platform for shares trading, and in the daily articles posted to eToro’s blog. However, the lack of technical analysis leaves eToro falling behind category leaders such as IG and Saxo Bank, and is a feature that would improve eToro’s Analyst Weekly series of articles.

Sentiment data: Only the trades of top traders at eToro are used to calculate sentiment data, rather than showing sentiment based on data from all users. This takes it a step above the usual sentiment tools brokers provide, and is similar to how CMC Markets displays this data.

Wall newsfeed: eToro uses a Twitter-style wall feed of collective commentary for each given instrument. This public feed appears as a stream of updates from other eToro users, designed to give you an idea of what other traders are posting about in the eToro network. As the content is sourced by eToro users, it can vary in quality. It is certainly unique; that said, I find content that is generated by in-house staff or from third-party professionals to generally be of higher quality.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | No |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

Education

While the eToro Learning Academy and blog offer a good number of videos, articles, and weekly webinars, the quality and volume trail educational leaders like AvaTrade, Saxo Bank or IG.

Learning center: eToro offers an online trading academy containing dozens of videos and articles that are organized by category and experience level.

Integrated educational tidbits: eToro provides extra details for beginners next to each symbol available within its platform, such as information about trading instruments (like the EUR/USD currency pair), and general facts to consider before investing.

Room for improvement: eToro has a decent number of videos on its YouTube channel, including archived webinars and market analysis, but I found it hard to distinguish between research, promotional, and educational videos. Organizing educational content by playlist and separating platform tutorials from financial market education would help to balance eToro’s video content in this category.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

eToro is great for retail traders who want to crowdsource investment ideas using the power of copy trading, or for highly-experienced active traders who want to be rewarded for sharing their ideas with other traders.

Less experienced traders that require some degree of handholding may find the user-friendly platform an added benefit. That said, I do not recommend eToro for active or high-volume traders, as higher spreads and small maximum trade sizes will be a limiting factor. Likewise, algorithmic trading is not supported.

When it comes to social copy trading and crypto trading, basically eToro remains our number one choice in 2022, and won our award for #1 Trader Community.

Is eToro trustworthy?

Is eToro really free?

Can you make money with eToro?

Is eToro good for beginners?

What type of broker is eToro?

About eToro

An early pioneer in social copy trading, eToro was founded in Israel in 2007 as a financial trading technology developer. After launching its first product, it has since grown to service over 13 million registered users with an innovative platform that continually evolves to be one of the largest social networks globally, with clients in over 140 countries.

Read more on Wikipedia about eToro.

Disclosures

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, and still there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.