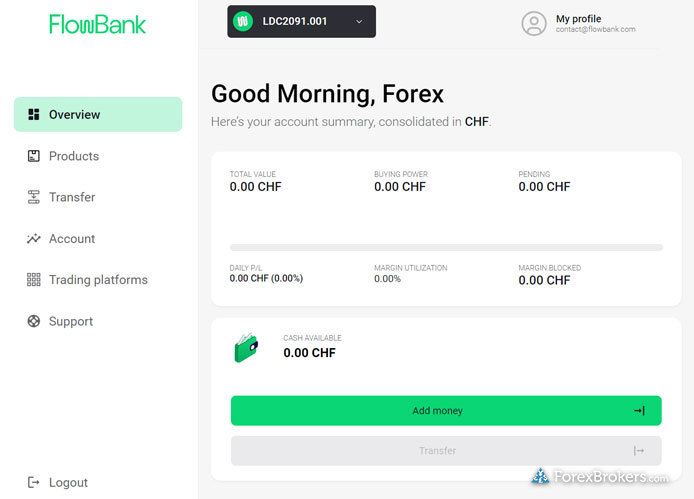

Overview

Trust score

Tradeable Symbols (Total): 408600

Year Founded:

Publicly Traded (Listed):

Bank:

As a relative newcomer to the Swiss online brokerage scene, FlowBank already has a lot to offer its customers. FlowBank clients benefit from the advantages that come with holding a Swiss bank account, and its brokerage services provide access to more advertised symbols than any online broker that we’ve reviewed thus far.

Pros

- Regulated by FINMA, FlowBank holds a prestigious Swiss Banking license, making it one of only a few forex brokers operating in Switzerland.

- Excellent choice for investing in local Swiss regional exchanges and financial markets

- Offers fractional shares on 10 popular U.S. companies.

- Provides connectivity to numerous global exchanges, with a vast selection of options markets, as well as forex, CFDs, and other derivatives such as exchange-traded securities.

- Offers in-house platforms alongside access to the full MetaTrader platform suite.

- FlowBank clients are protected with up to $100,000 in deposit insurance from esisuisse (membership in this self-regulatory organization is mandatory for all banks in Switzerland).

- Daily forecasts powered by Technical Speak Easy, featuring integrated trading signals.

- The FlowBank app is streamlined and designed for beginner investors.

Cons

- FlowBank is a relatively new broker with a limited operating history.

- The FlowBank Pro app for mobile and desktop lacks integrated research.

- FlowBank’s scope of educational materials is limited compared to category leaders.

- Charts have a limited historical data range (e.g., less than one year of EUR/USD data for charting analysis).

- FlowBank charges a quarterly custody fee (regardless of whether you’ve been actively trading) which ranges from 10 to 50 CHF.

- The FlowBank Pro platform’s design doesn’t yet compete with more modern platforms (such as Saxo Bank’s SaxoTraderPRO).

FlowBank Investment Products

What can I trade?

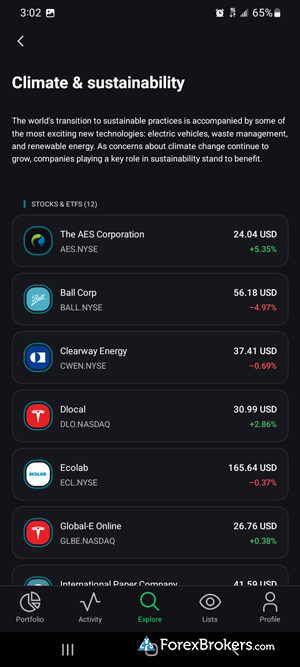

FlowBank offers a staggering number of investment products across a wide range of asset classes, with more symbols than the majority of online brokers.

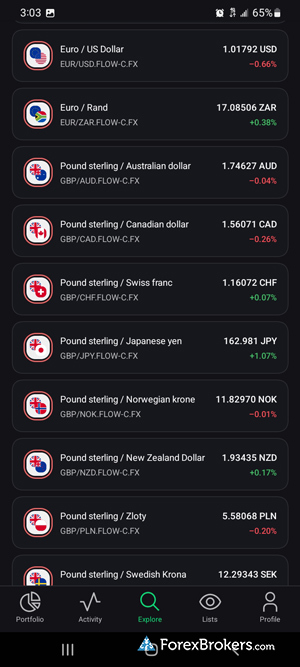

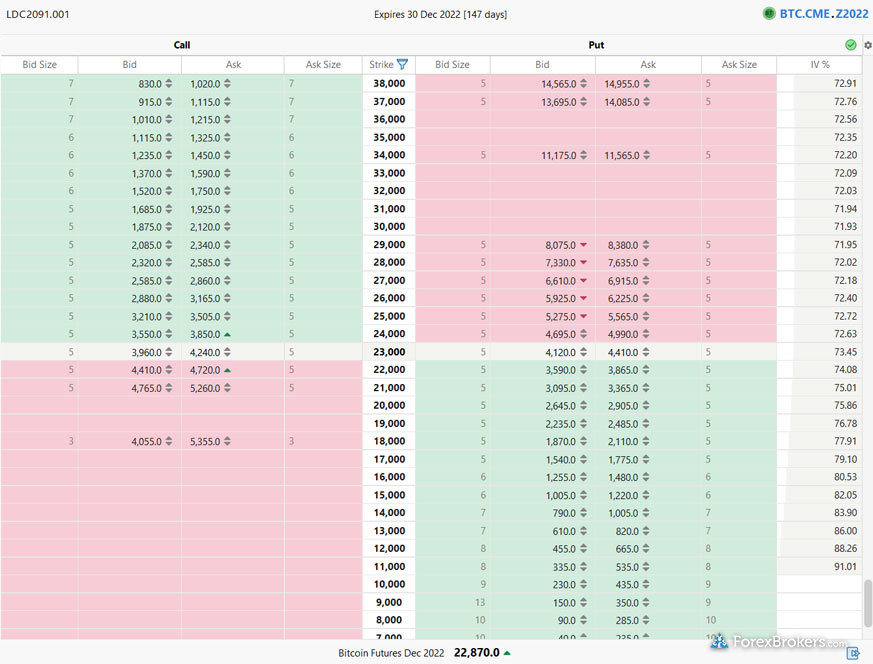

A true multi-asset broker, FlowBank offers a substantial range of products that includes 4,751 CFDs, 53 forex pairs, 48 crypto derivatives, 2,131 funds and OTC products, 15,926 shares, 936 futures, and a whopping 382,433 options when counting all available options contracts and expiries at various strike prices.

Excluding options, FlowBank offers 26,118 symbols – that number alone is still more than the total symbols offered by most brokers. This massive list of products can be navigated dynamically by asset class from within the trading platform, making it the single largest product offering with that ability. Only Swissquote offers a greater number of products – check out our review of Swissquote for more information.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 408600 |

| Forex Pairs (Total) | 51 |

| U.S. Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

FlowBank Fees

What are my trading costs?

FlowBank clients pay a premium to hold a Swiss bank account, but they gain access to competitive minimum spreads, and rebates are available for high-volume forex traders.

FlowBank does not publish average spreads across its account types, so we were unable to evaluate its pricing at a granular level. That said, FlowBank’s Platinum account – which requires a minimum deposit of 100,000 CHF deposit – advertises a minimum (not average) spread of 0.5 pips. Though this minimum spread is the same as what’s offered with FlowBank’s Classic account, the Platinum account boasts commission rates that are 50% lower (when trading shares and options). Outside of the broker’s Platinum account, the minimum deposit – and any related fees – may vary depending on your country of residence.

Active Traders: Rebates are also available for high-volume forex traders with at least $50 million in turnover. This program pays back 3 CHF per million for the first tier, and 7 CHF if you trade more than $500 million per month.

FlowBank also publishes its monthly trading volumes, from the risk it internalizes on accounts with market-making execution, and provides agency execution for certain of its investment products. And while FlowBank lists a zero dollar minimum account requirement to open an account, this may vary depending on your country of residence.

Other fees

Custody fees: With some brokers, inactivity fees can be avoided by placing a trade within a set time period. FlowBank’s custody fees, however, cannot be avoided. Traders will pay a small quarterly custody fee ranging from 10 CHF to a maximum of 50 CHF (based on a rate of 0.10% of assets, plus VAT).

Traders tend to pay a premium to hold an account with a Swiss Bank that has brokerage capabilities, and FlowBank is no exception. Saxo Bank, for example, also has a presence in Switzerland as a bank, and will charge custody fees when you hold open positions on certain stocks (even if they aren’t CFDs, or leveraged). FlowBank just charges this fee at the account level, rather than by instrument.

Share pricing: It’s here where FlowBank’s pricing really shines, allowing traders to trade securities and invest in local Swiss exchanges on a commission-free basis.

Market data subscriptions: Fees per venue for real-time data can vary at FlowBank, ranging from as low as $1 per month when subscribing to NYSE AMEX or NASDAQ data, to as much as $125 per month for ICE EU Commodities.

| Feature |  |

| Minimum Initial Deposit | $0.00 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

Can I trade on the go?

Traders can pick and choose from a handful of available mobile apps at FlowBank, but won’t find any bells and whistles in these mobile platforms.

With FlowBank, traders gain access to four mobile apps: the full MetaTrader suite (MetaTrader 4 and 5), as well as the proprietary FlowBank app for mobile and FlowBank Pro for mobile and desktop.

MetaTrader: Traders who choose to use the MetaTrader suite at FlowBank will find the no-frills MetaTrader experience, with no standout extra features.

FlowBank app: The FlowBank app is mobile-only, and primarily functions to support banking clients. The FlowBank app experience is reminiscent of the Robinhood app – a simple, and a straightforward app experience that’s been stripped of any added features.

FlowBank Pro app: The FlowBank Pro app is available for mobile and desktop, and features a greater focus on trading (as compared to its simpler counterpart, the FlowBank app). I found the interface easy to use and far more modern than the standard desktop version, though its lack of market research and integrated news left me wanting more from the experience.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 37 |

| Charting – Drawing Tools (Total) | 17 |

Other trading platforms

What trading platforms can I use?

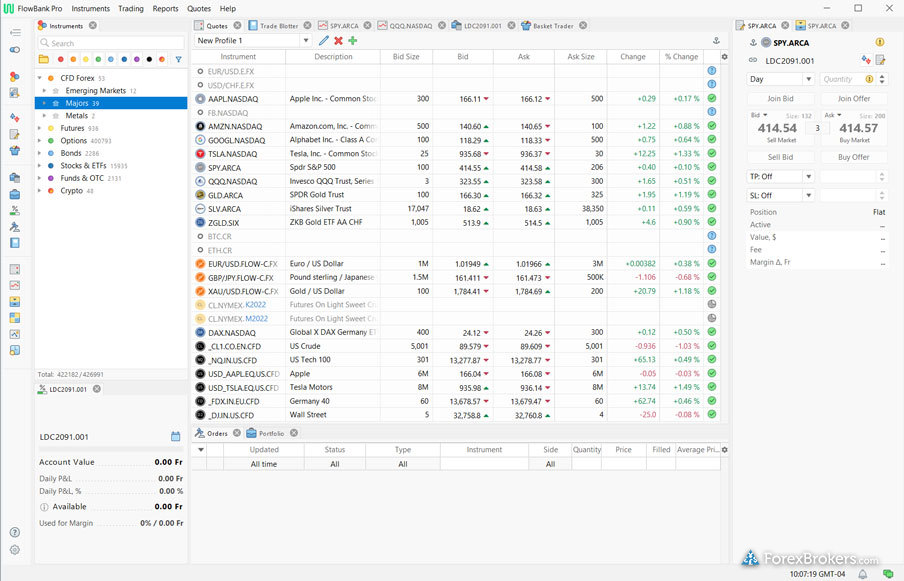

FlowBank’s flagship platform – FlowBank Pro – offers a true multi-asset experience with decent supplementary features. However, this isn’t the most powerful – or the sleekest – platform suite we’ve seen.

FlowBank offers the full MetaTrader platform suite, alongside the broker’s proprietary FlowBank Pro platform suite.

MetaTrader: Though traders at FlowBank gain access to the full MetaTrader suite (MT4 and MT5) from MetaQuotes Software, there are no major enhancements, platform add-ons, or plugins to distinguish FlowBank as a top MetaTrader broker. It’s also worth noting that the available range of markets for MetaTrader at FlowBank is significantly smaller (just under 300) than the staggering range of markets available on the Flow Bank Pro platform.

Ease of Use: My first impression of the FlowBank Pro desktop platform was that it resembles a trading application from the early 2000s. In other words, functionality takes precedence over appearance. FlowBank user experience is not optimized for beginners, and the aptly-named platform is more suited to professional traders.

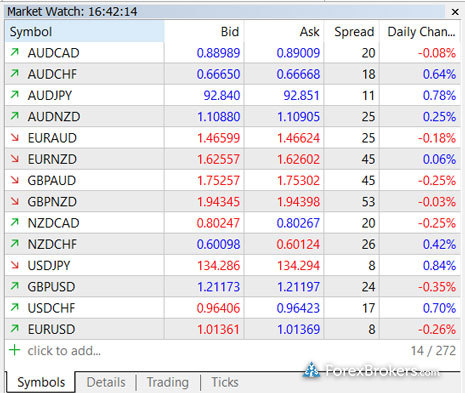

Watchlist

FlowBank Pro’s watchlist supports up to 40 columns, including dedicated parameters for bonds and options trading, as well as coupon discount and expiry. Coupled with the ability to create additional custom watchlists, also these added fields have the potential to transform the watchlist into a stock screener tool, allowing you to scan multiple securities, including options, forex and CFD markets.

Charting: Charts in FlowBank Pro are decent, and feature 37 indicators and 17 drawing tools. The biggest drawback that comes with using FlowBank Pro’s desktop charts is the limited historical data available on symbols such as the EUR/USD or Bitcoin. By default, charts load just two years of data. Traders who are serious about technical analysis demand at least 10-15 years’ worth of data, and some of the best brokers provide an even greater range of historical price data within their charting modules. Link opportunity to StockTrader?

Charting aside, I was impressed with the display and organization of global markets within the FlowBank Pro platform. At a glance, traders can see the exchange or asset class, as well as the number of available symbols from that venue.

The FlowBank Pro platform’s most significant shortcoming is its limited historical data for technical analysis. Though it also lacks integrated research, it has a lot of potential and demonstrates how far FlowBank has come in such a short period of time.

Overall, FlowBank Pro delivers a true multi-asset experience, with a range of investment products that’s comparable in scope to industry leaders such as Interactive Brokers, IG and Saxo Bank.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

FlowBank Market research

Can I stay informed about the markets?

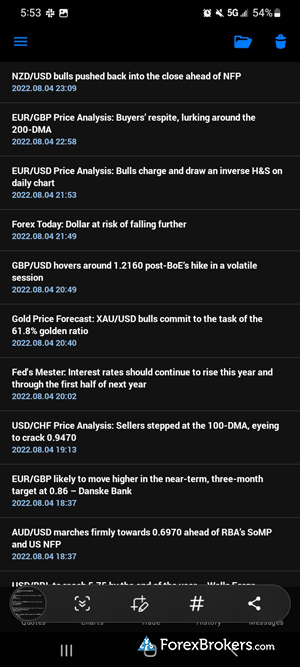

FlowBank provides a variety of good-quality market research and content in multiple formats, but integrated research is curiously absent from its by FlowBank Pro platform.

Research at FlowBank consists of newsletter articles, videos, trading signals, and periodic (daily, weekly, and monthly) content updates. The MetaTrader platform provides integrated news articles, but FlowBank’s own Pro platform suite lacks market research altogether.

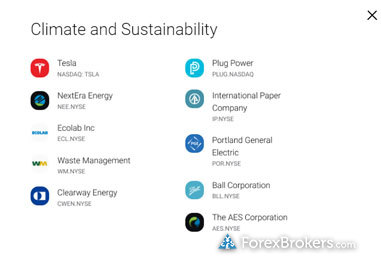

Research overview: Research at FlowBank primarily lives on the broker’s website. FlowBank’s LiveWire news feed offers market updates, its daily MarketFlow newsletter is available each morning, and its Market Insights section features daily articles and blog posts. Where i found the Popular Theme series in particular to be useful, though the section definitely has room to expand.

Market news and analysis: LiveWire features technical analysis reports, and the broker’s FlowTV video series (on YouTube) contains good-quality videos, with content that ranges from basic to advanced.

That said, the broker’s video content is fairly limited in length and overall variety (particularly when compared to category leaders such as IG and Interactive Brokers). Though FlowBank has already laid a decent foundation here – especially for a two-year old brokerage – there’s plenty of room for the broker to improve in this category.

Trading signals: Powered by Technical Speak Easy, trading signals are directly integrated within FlowBank’s website and nicely organized by asset class, with detailed analysis accompanying each signal. Integrating this feature within the FlowBank Pro platform would be a welcome enhancement, and would help to fill the void of research on FlowBank Pro.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

FlowBank Education

Can I learn how to trade and invest?

FlowBank isn’t the best place for traders to start – or continue – learning about trading and investing. There’s a small selection of educational content and some webinars, but that’s about it.

Education is a category where FlowBank has considerable opportunity for growth. Currently, its offering consists of a dozen or so videos and articles, as well as platform tutorials for FlowBank’s own platforms.

Learning center: I enjoyed watching some of the broker’s archived webinars, though there didn’t appear to be any upcoming webinars in the future.

Room for improvement: The content I did find at FlowBank was good, but expanding the variety of subject matter will only benefit traders who are looking to expand their knowledge of financial markets. Introducing dedicated video playlists organized by topic or experience level would improve the user experience at FlowBank, and I always encourage the addition of progress tracking and quizzes to enhance the overall educational experience.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | No |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | No |

Final thoughts

FlowBank offers traders and investors the allure of holding a Swiss bank account (and all the associated benefits) while still providing access to a multi-asset brokerage solution – all from one account.

FlowBank caters to both beginners and advanced traders with its mobile app and FlowBank Pro platform. That being said, the platform would benefit from the addition of more robust market research, as well as more extensive historical data for its charts. It also wouldn’t hurt to bring the design of the Pro platform up to today’s standards, like its mobile banking app.

Overall, FlowBank impresses as a true multi-asset broker. While it may lack some of the advanced features offered by the best brokers, you can access more advertised symbols at FlowBank than at IG, CMC Markets, or Plus500. As a company that is barely two years old, FlowBank has made an astounding amount of progress in such a short period, and at this pace, I am eagerly looking forward to its future developments.

About FlowBank

FlowBank was founded in 2020 by Charles Henri Shabet, a forex brokerage industry veteran with a long history of leading global online brokerages. In March of 2022, crypto investment firm CoinShares (OTCQX: CNSRF) increased its stake in FlowBank by investing the equivalent of $26.5 million and joined its board with nearly a third of the voting rights following approval from FINMA, the Swiss regulatory body.

Is FlowBank legit?

What type of broker is FlowBank?

What is the minimum amount required to open a FlowBank account?

2022 Review Methodology

For our 2022 Seven roker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, it also providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection. And market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.