Overview

Trust score

Tradeable Symbols (Total): 2179

Year Founded: 1999

Publicly Traded (Listed): Yes

Bank: No

Markets.com is publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). Markets.com is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Markets.com is considered low-risk, with an overall Trust Score of 98 out of 99.

Pros 👍🏻

- Free and fast deposit and withdrawal

- Easy and fast account opening

- Great tools for learning and research

Cons 👎🏻

- High forex fees

- Limited product portfolio

- Platforms lack some common features

Offering of Investments

Overall, compared to the Markets.com Metatrader offering, the MarketsX platform offering would be my choice because of its lower comparable spreads and access to a more significant number of tradeable instruments (57 forex pairs and 2,179 CFDs).

The following table summarizes the different investment products available to Markets.com clients.

Cryptocurrency: Cryptocurrency trading is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s UK entity, nor to UK residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 2179 |

| Forex Pairs (Total) | 57 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Markets.com Commissions and Fees

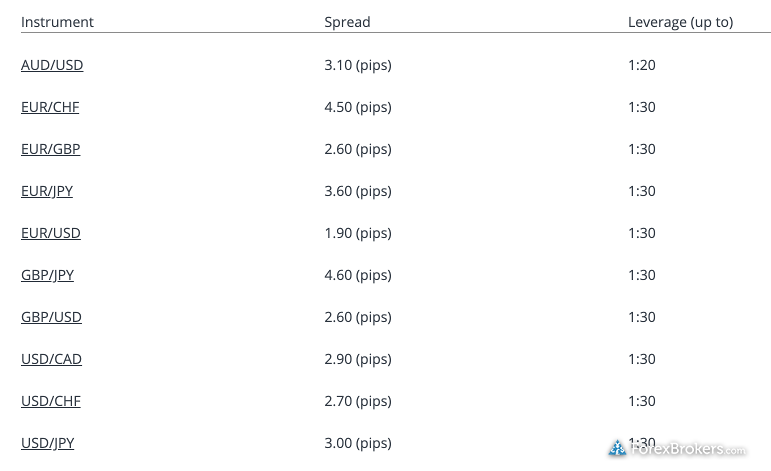

Assessing Markets.com for trading costs is tricky. All in all, our bottom line assessment is that Markets.com is expensive and far from being competitive with industry leaders CMC Markets and IG.

MarketsX: Markets.com offers a premium account called MarketsX for traders who deposit at least $250, where spreads are comparably lower than its primary account offering and with added platform benefits.

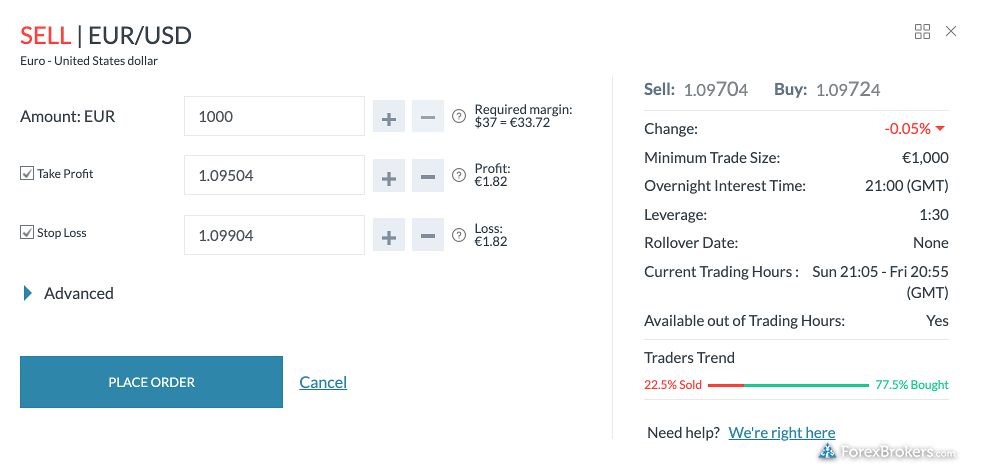

Variable spreads: In terms of trading costs, spreads at Markets.com changed from being fixed to variable on its forex pairs, bringing the broker in line with most multi-asset brokers that offer variable spreads. That said, the minimum listed spreads are still comparably higher, and I was unable to make an adequate comparison given the lack of average spread data published by the broker.

MetaTrader accounts: It’s also worth noting that spreads are generally tighter on the company’s proprietary Web Trader platform, compared to its third-party trading platforms offered, including MT4 and MT5, where the product range is not as extensive.

Average spreads: The firm advertises spreads as low as 1.9 pips on the EUR/USD, and 3.0 pips on its MT4 offering, which are more expensive when compared to other firms with variable (floating) spreads. Summary aside, we would like to see Markets.com share average spread data for its new variable spread offering, to help make a level comparison with other brokers with variable spreads.

| Feature |  |

| Minimum Initial Deposit | $100 |

| Average Spread EUR/USD – Standard | 1.9 (as of Oct 2019) |

| All-in Cost EUR/USD – Active | 1.9 (as of May 2019) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | No |

| Execution: Market Maker | Yes |

Markets.com Platforms and Tools

Markets.com offers its flagship trading platform, MarketsX, as well as the full MetaTrader suite.

MarketsX charting: In terms of charting in MarketsX, there are nearly 90 indicators available for technical analysis – which is more than the industry average. That said, only four drawing tools are available.

MarketsX usability: Web Trader is very easy to use. Throughout the platform, Markets.com has emphasized providing traders a smooth user experience. For example, alongside pre-defined screeners, module linking is enabled by default.

MetaTrader: Markets.com also offers MetaTrader4 (MT4) and MetaTrader5 (MT5) for algorithmic traders, although pricing is higher compared to its flagship platform.

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 89 |

| Charting – Drawing Tools (Total) | 4 |

| Charting – Trade From Chart | No |

| Watchlists – Total Fields | 6 |

Markets.com Research

Overall, Markets.com has a good foundation for research. However, there remains room for further improvement as the broker trails industry leaders IG and Saxo Bank. For example, adding content from in-house analysts, a heatmap tool, or forex news videos would improve Markets.com’s research offering.

Third-party research: Research from third-parties includes TipRanks and pattern recognition from Delkos.

Integrated tools: I enjoyed exploring the modules under the Sentiment tab, including the Insider Trades, Analyst Recommendations, Bloggers Opinion, and the Hedge Fund Confidence section. The Fundamental section was also rich with tools, including the Events & Trade section, which contains useful event-related analysis, alongside financial news and market commentary.

Reports: Another highlight is that Markets.com provides detailed research reports for many of its single-share CFDs.

Education: Markets.com also does an excellent job integrating live webinars into its trading platform as part of its XRay offering and educational video content from Trading Central (Recognia).

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | No |

| Social Sentiment – Currency Pairs | Yes |

Markets.com Mobile Trading

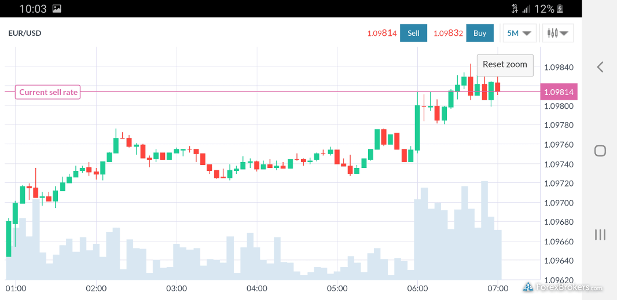

Besides the MT4 native app available for mobile, Markets.com also offers its proprietary mobile app as a counterpart to the MarketsX web-based platform. Like MT4 mobile, the Markets.com app is available for Android and iOS devices.

Pros: The Markets.com mobile app combines many features found in the flagship platform, keeping a consistent look and feel across both platforms, with nearly all features available. For example, I was pleased to see most of the research resources from the web version integrated into the mobile app under the trading tools tab.

Cons: While the Markets.com mobile experience is respectable, the charting tool lacks drawing tools and indicators, which leaves a notable gap in the mobile offering. Also, watch lists don’t sync across platforms.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 6 |

| Watchlist Syncing | Yes |

| Charting – Indicators / Studies (Total) | 89 |

| Charting – Drawing Tools (Total) | 4 |

| Mobile Charting – Draw Trendlines | Yes |

| Charting – Multiple Time Frames | No |

| Forex Calendar | No |

Final Thoughts

Thanks to its MarketsX platform, Markets.com provides a decent balance of simplicity and functionality. That said, Markets.com research tools are respectable but still trail industry leaders. And while spreads have improved, Markets.com remains expensive, especially on its MetaTrader offering. All in all, Markets.com finished Best in Class across three categories in 2020, including Ease of Use, Beginners, and Trust Score, which are key areas where it stands out against peers.

About Markets.com

Markets.com’s parent company, Playtech, has been listed on the London Stock Exchange (LSE) since 2012 under ticker symbol PTEC and is part of the FTSE 250 Index. As of June 2019, the company boasts a market capitalization of over £1.2 billion and holds £304m in cash on its balance sheet.

Playtech develops gambling, casino, and financial trading technology that powers its brands’ products, including those of Markets.com. The broker serves forex and CFD traders through its proprietary and third-party trading platforms under the Markets.com brand. Read more on Wikipedia about Markets.com.

2022 Review Methodology

For our 2022 Seven Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.