TradeZella Review 2024: A Comprehensive Look at the Revolutionary Trading Journal

Initial Deposit: £100.00

Overview

Trust score

Tradeable Symbols (Total): 13500

Year Founded: 4.3/5

Publicly Traded (Listed): Yes

Bank: No

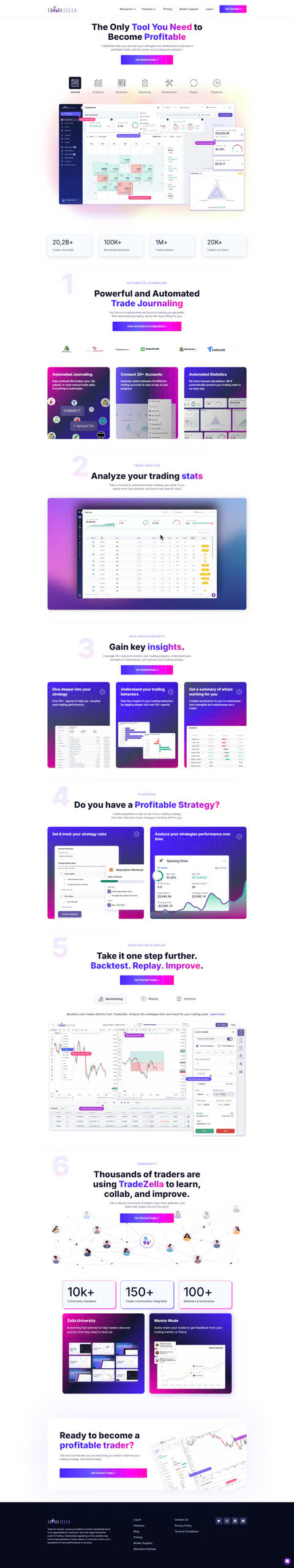

In the ever-evolving world of trading, having the right tools to analyze and refine your strategies can make the difference between consistent profits and recurring losses. Enter TradeZella, a cutting-edge trading journal that has rapidly risen to prominence since its launch in 2020. Designed by Umar Ashraf, a respected figure in the trading community, TradeZella goes beyond traditional journaling by offering traders actionable insights and advanced analytics tailored to their needs.

In this review, we’ll explore TradeZella’s features, benefits, pricing, and how it compares to its competitors, helping you decide if it’s the right tool for your trading journey.

Tradezella is considered low-risk, with an overall Trust Score of 99 out of 99

Pros 👍🏻

- Automated trade logging saves time and reduces errors.

- Highly customizable analytics for tailored insights.

- Trade replay functionality enhances learning and strategy refinement.

- Intuitive interface suitable for traders at all levels

Cons 👎🏻

- Slight learning curve for beginners unfamiliar with advanced analytics.

- Higher cost compared to basic trading journals, though the value justifies the price for active traders.

What is TradeZella?

TradeZella is a cloud-based trading journal that tracks, analyzes, and helps improve trading performance. Unlike conventional trading journals that require manual input, TradeZella automates the process, saving traders time and providing deeper insights into their trading behavior.

Its primary focus is on helping traders identify their strengths, correct recurring mistakes, and optimize their strategies for long-term success.

Top Features of TradeZella

TradeZella’s popularity stems from its robust set of features designed for both beginner and professional traders. Here’s a closer look:

1. Automated Trade Logging

Gone are the days of manually entering every trade into a spreadsheet. TradeZella automatically logs trades by integrating with popular brokers, allowing you to focus on analyzing your performance instead of inputting data.

2. Trade Replay Functionality

The trade replay feature is a standout. It allows you to revisit past trades in a simulated environment, letting you analyze your decision-making process. This feature is invaluable for day traders who need to refine their skills in a high-speed trading environment.

3. In-Depth Analytics and Reports

TradeZella provides customizable analytics that dig deep into your trading history. Key metrics include:

- Win/Loss Ratios

- Risk-to-Reward Analysis

- Error Tagging and Trend Identification

These analytics enable you to pinpoint what’s working and what needs improvement.

4. Error Tagging

One of TradeZella’s most practical features is its error tagging system. By categorizing mistakes like overtrading or ignoring stop-loss levels, you can identify patterns and implement changes to minimize losses.

5. User-Friendly Interface

TradeZella is built with simplicity in mind, ensuring that traders of all skill levels can navigate and utilize the platform effectively. Its clean design makes reviewing trades a seamless experience.

6. Cloud-Based Accessibility

As a cloud-based platform, TradeZella allows you to access your trading journal from anywhere—whether you’re at home, traveling, or on the trading floor.

Who Should Use TradeZella?

TradeZella is suitable for a wide range of traders, including:

- Beginner Traders: Looking to build good habits and analyze their early trading mistakes.

- Experienced Traders: Aiming to refine strategies and maximize profits.

- Day Traders: Needing tools to replay trades and improve decision-making under pressure.

- Swing Traders: Wanting detailed insights into longer-term trade performance.

TradeZella vs. TraderSync: How Does It Compare?

When comparing TradeZella to other trading journals like TraderSync, each platform offers unique advantages:

Why Choose TradeZella?

- Customization: TradeZella allows traders to tailor their analytics dashboard to suit specific goals.

- Trade Replay: Its replay feature offers detailed insights, helping traders identify and correct errors.

- Ease of Use: A user-friendly interface makes TradeZella accessible even for beginners.

Why Choose TraderSync?

- AI-Driven Insights: TraderSync’s AI assistant provides actionable feedback, acting as a virtual trading coach.

- Strategy Tracker: Helps traders stick to their predefined strategies with discipline.

- Interactive Charts: Allows for visual analysis of trading patterns and performance.

While TraderSync’s advanced features like AI assistance cater to tech-savvy traders, TradeZella’s straightforward design and deep customization options make it a top choice for those focused on performance refinement.

TradeZella vs. TraderVue: A Closer Look

When considering trading journals, both TradeZella and TraderVue stand out as excellent tools tailored for traders. Each platform offers unique features, but which one is better suited for your needs?

Why Choose TradeZella?

TradeZella excels in delivering an intuitive, analytics-driven experience with features like:

- Trade Replay Functionality: While TraderVue also supports trade reviews, TradeZella’s replay feature creates a more immersive experience, letting traders revisit and analyze their trades in real time.

- Error Tagging and Trend Identification: TradeZella categorizes mistakes and highlights behavioral patterns, giving traders actionable feedback.

- Customizable Analytics Dashboard: TradeZella allows users to tailor their metrics and reports based on their individual trading strategies, ensuring a personalized approach.

- Pricing Advantage for Premium Features: TradeZella offers its Premium Plan at $49/month, which includes advanced features like trade replay, error tagging, and in-depth analytics—features that require higher-tier plans in TraderVue.

Why Choose TraderVue?

TraderVue, on the other hand, has been in the market longer and offers distinct advantages, particularly for traders managing larger portfolios or requiring advanced reporting tools:

- Shared Journal Functionality: TraderVue allows users to share journals with mentors or trading groups, fostering collaborative learning—a feature not yet present in TradeZella.

- Performance Insights with Multi-Account Support: Ideal for traders managing multiple accounts, TraderVue integrates these into one cohesive platform for seamless performance analysis.

- Advanced Reporting Features: TraderVue provides granular, interactive reports that cater to professional and institutional traders.

Pricing Comparison

| Feature | TradeZella Premium Plan ($49/month) | TraderVue Pro Plan ($49/month) |

| Automated Trade Logging | ✔ | ✔ |

| Trade Replay | ✔ | ✘ |

| Error Tagging | ✔ | ✔ |

| Multi-Account Support | ✘ | ✔ |

| Shared Journaling | ✘ | ✔ |

While both platforms provide great value, TraderVue is better suited for traders seeking collaborative or multi-account functionalities. In contrast, TradeZella caters to those prioritizing trade replay and highly customizable analytics.

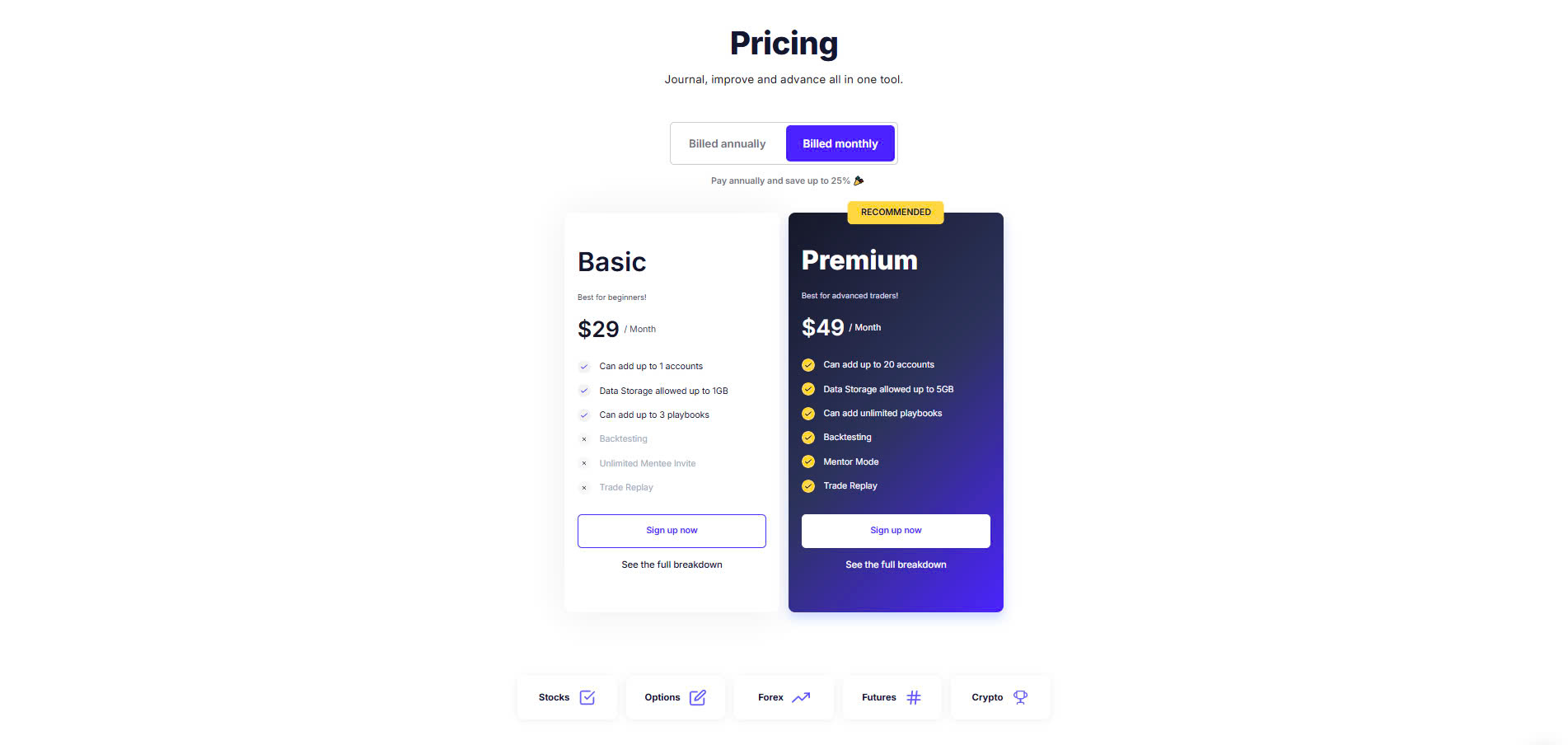

TradeZella Pricing

TradeZella offers a straightforward pricing structure:

- Basic Plan: $29/month or $280/year – Includes essential features like automated journaling and basic analytics.

- Premium Plan: $49/month or $399/year – Unlocks advanced features such as in-depth analytics, trade replay, and error tagging.

For serious traders, the premium plan is worth the investment, offering tools to maximize trading potential.

Pros and Cons of TradeZella

Pros

- Automated trade logging saves time and reduces errors.

- Highly customizable analytics for tailored insights.

- Trade replay functionality enhances learning and strategy refinement.

- Intuitive interface suitable for traders at all levels.

Cons

- Slight learning curve for beginners unfamiliar with advanced analytics.

- Higher cost compared to basic trading journals, though the value justifies the price for active traders.

Is TradeZella Worth It?

If you’re serious about improving your trading performance, TradeZella is an invaluable tool. It offers everything you need to track your progress, identify mistakes, and build a profitable trading strategy. Its combination of automation, analytics, and usability sets it apart from traditional trading journals and makes it a worthy investment for traders of all levels.

Final Thoughts

In today’s competitive trading environment, a reliable trading journal isn’t just helpful—it’s essential. TradeZella delivers on its promise to help traders analyze, learn, and grow. Whether you’re a novice looking to build good habits or a seasoned trader refining your edge, TradeZella’s features and insights can take your trading game to the next level.

Ready to elevate your trading performance? Give TradeZella a try and see the difference it can make.

Reviews

There are no reviews yet.