Overview

Trust score

Tradeable Symbols (Total): 257

Year Founded: 2009

Publicly Traded (Listed): No

Bank: No

Vantage is not publicly traded and does not operate a bank. Vantage is authorised by two tier-1 regulators (high trust), zero tier-2 regulators (average trust), and two tier-3 regulator (low trust). Vantage is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Vantage is considered average-risk, with an overall Trust Score of 83 out of 99.

Pros 👍🏻

- The Vantage brand maintains regulatory status in two tier-1 jurisdictions and one tier-3 jurisdiction, making it a safe broker (average risk) for trading forex and CFDs.

- Holds indemnity insurance for additional protection in excess of any regulatory coverage.

- Vantage has done an excellent job of fully integrating the TradingView platform into the MetaTrader suite.

- Offers Smart Trader add-ons for MetaTrader and multiple social copy-trading platforms (not available in Australia).

- Vantage again ranks among the Best MetaTrader Brokers and the Best Copy Trading Brokers for 2022.

Cons 👎🏻

- The Pro ECN account requires a minimum deposit of $20,000, making it ill-suited for budget investors.

- Access to Pro Trader Tools powered by Trading Central requires a $1,000 deposit.

- Spreads on the Standard account do not impress, unless you deposit at least $10,000 to become eligible for active trader rebates.

Offering of investments

The range of available markets at Vantage will depend on which entity regulates your account. Vantage’s Australian entity, for example, offers 257 instruments, while its Cayman Islands brand offers 201. The following table summarizes the different investment products available to Vantage clients.

Cryptocurrency: Cryptocurrency trading is available at Vantage through CFDs and through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

| Feature |  |

| Forex Trading (Spot or CFDs) | Yes |

| Tradeable Symbols (Total) | 257 |

| Forex Pairs (Total) | 44 |

| U.S. Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Disclaimers | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

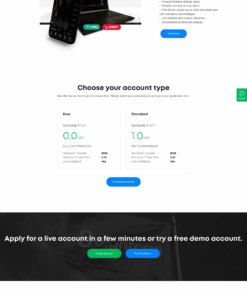

Trading costs at Vantage depend on which account you open and on which specific Vantage entity holds your account. There are three account options at Vantage: the spread-only Standard STP account, and the commission-based RAW ECN and PRO ECN accounts. Overall, Vantage’s pricing falls mostly in line with the industry average, but can’t compete with pricing leaders Saxo Bank, IG, and CMC Markets.

Standard vs. Raw accounts comparison: Vantage lists typical spreads of 1.22 pips on the EUR/USD (for the month of August 2021) for its spread-only Standard account. For its Raw account, average spreads are 0.15 pips with a commission of $3 added per side ($6 per round turn), totaling 0.75 pips during the same time period.

PRO account: The PRO account from Vantage has competitive pricing, with its per-side commission amounting to just $2 (or $4 per round turn). Requirements for opening a PRO ECN account with Vantage fluctuate between its regulating entities. Its Australian entity requires that you qualify to be categorized as a wholesale client. If you open your account under Vantage’s Cayman Islands entity, you must fund your account with at least $20,000. For those who can meet its various account requirements, the PRO ECN account is Vantage’s best-priced option, and is comparable to similar accounts offered by FP Markets and Tickmill.

Active traders: The active trader program from Vantage offers rebates ranging from $2 to as much as $8 per standard lot, depending on your balance and monthly volume. The smallest tier starts at $10,000 and the highest tier requires at least $300,000 in equity. However, it is only available on the Standard account, which has the highest spreads from among all the account options available.

| Feature |  |

| Minimum Initial Deposit | $50 |

| Average Spread EUR/USD – Standard | 1.22 (August 2021) |

| All-in Cost EUR/USD – Active | 0.75 (August 2021) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

Vantage offers its own proprietary trading app, alongside the standard MetaTrader suite of mobile apps. Vantage has built a decent foundation for a new mobile trading application with its Vantage App. However, I am not a fan of the ads, and it is still a long way off from being able to compete with the mobile apps that are offered by IG, FOREX.com, and Saxo Bank.

Apps overview: Vantage offers two mobile apps: its proprietary Vantage App, and the MetaTrader platform suite. The MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Vantage mobile app come standard from their developer for iOS on Apple App Store and for Android on Google Play.

Ease of use: I found the advertisements within the Vantage app to be a distraction from the trading experience. I’d prefer to avoid ads and promotional content when using a mobile trading app. That being said, Vantage has done a good job of integrating research, with newsletter updates, signals, and multiple Trading Central-powered videos per day.

Charting: Charting at Vantage allows for only five time frames, one chart type, and just a handful of indicators and overlays. On the plus side, tapping on the chart launches it into a full-screen landscape view, which is a nice touch. In contrast, charting from Plus500 comes with over 100 indicators and allows for the ability to use multiple indicators at the same time.

| Feature |  |

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Alerts – Basic Fields | Yes |

| Watchlists – Total Fields | 7 |

| Watchlist Syncing | No |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

| Mobile Charting – Draw Trendlines | Yes |

| Charting – Multiple Time Frames | No |

| Forex Calendar | Yes |

Other trading platforms

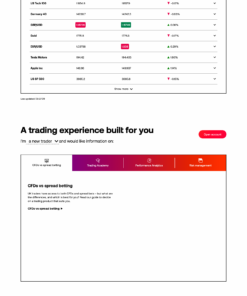

Vantage distinguishes itself from other MetaTrader-only brokers by offering a diverse range of additional add-ons and by supporting the integration of compatible third-party platforms and tools, such as TradingView. As a result, Vantage finished among the Best in Class in our best MetaTrader brokers category for 2022.

Platforms overview: Vantage is primarily a MetaTrader broker offering the full suite of desktop and web trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Charting: Besides the standard charts on MT4 and MT5, Vantage also offers the CHARTS platform from TradingView, which is fully integrated and allows you to log in with your MetaTrader account.

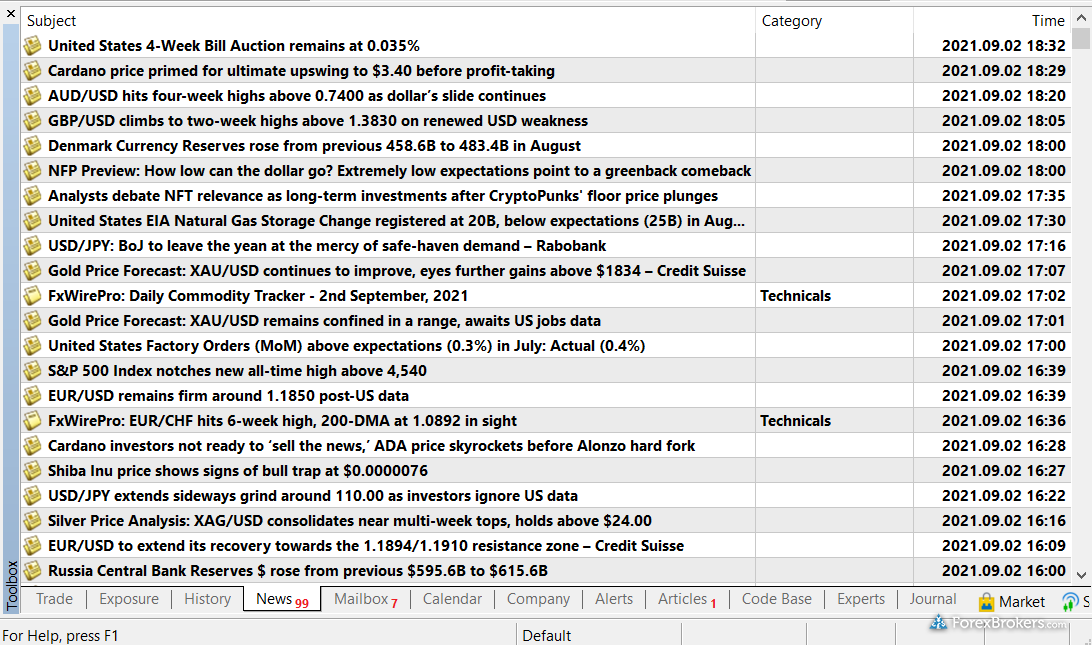

Trading tools: For MetaTrader, Vantage offers the SmartTrader Tools from FX Blue LLP’s suite of platform add-ons. Also, forex news headlines stream directly from FxWire Pro and FxStreet, helping to round out Vantage’s impressive MetaTrader offering.

Copy trading: In addition to the Signals market on MetaTrader, Vantage offers three platforms for social copy trading. The auto-trading platform trio includes ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade (although these are not available in Australia).

| Feature |  |

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | Yes |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | 30 |

| Charting – Drawing Tools (Total) | 15 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

Market research

Vantage’s research is sourced primarily from third-party content providers such as Trading Central, and it lacks substantial in-house content. Considering the quality and depth of research that is made available by the best forex brokers such as IG, Saxo Bank, and CMC Markets, there remains considerable room for Vantage to improve in this category.

Research overview: Vantage publishes daily market updates to its dedicated YouTube Channel. These updates are powered by Trading Central, and I found them to be just OK. My only gripe is that they are highly-templated, and feature pre-recorded pieces of content that repeat across every video. Meanwhile, nestled away in the trading tools section of the client portal are more engaging videos (also from Trading Central) that add to Vantage’s video offering of market news and analysis.

Market news and analysis: Also powered by Trading Central is the Pro Trader Tools product, which is offered to clients with at least $1,000 on deposit and is integrated directly within the client portal. Other useful features include its Featured Ideas tool, which is useful for traders looking for trading signals and actionable ideas, while the Analyst Views feature delivers automated analysis.

Future enhancements: Vantage’s scope of research resources continues to expand. That said, I’d like to see an increase in the range of its in-house content, particularly webinars and written content.

| Feature |  |

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | No |

| Trading Central (Recognia) | Yes |

| Social Sentiment – Currency Pairs | Yes |

Education

Vantage does not offer a comprehensive range of educational resources for traders, putting it at a disadvantage against brokers that make education a priority, such as CMC Markets or City Index.

Learning center: Vantage’s Learn Forex Trading section features 37 expandable educational points, though I found them to be unsophisticated. In addition to platform tutorials, Vantage provides a library of over 130 videos developed by Trading Central as part of its Pro Trader series. Content ranges from short introductory clips for beginners to longer videos featuring advanced forex and CFD concepts across various markets – including cryptocurrencies. I found many of these videos produced by Trading Central useful.

Room for improvement: Vantage would benefit from an expansion of archived content (such as webinars) on its YouTube channel, as well as a more comprehensive selection of written articles.

| Feature |  |

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | No |

| Videos – Beginner Trading Videos | No |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Vantage distinguishes itself from other MetaTrader brokers by offering competitive pricing on its commission-based Raw ECN account and by supporting the integration of additional platforms such as Zulutrade and DupliTrade. It also offers its own proprietary Vantage app, which – despite the added distraction of in-app ads – shows real promise as a trading platform.

While the broker’s research and educational offerings continue to expand, Vantage has a ways to go if it wants to compete with the best brokers in those categories.

About Vantage

Founded in 2009 as MXT Global and formerly known as Vantage FX, today Vantage is a member of Vantage Global Prime Pty Ltd. The Vantage brand holds an Australian Financial Services License (AFSL) with the Australian Securities and Investment Commission (ASIC).

The group also has an entity regulated in the U.K. by the Financial Conduct Authority (FCA) under Vantage Global Prime LLP, for institutional clients. Vantage also has an entity that holds regulatory status with the Cayman Islands Monetary Authority (CIMA), and by the Vanuatu Financial Services Commission (VFSC) in Vanuatu.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

Reviews

There are no reviews yet.