Overview

Trust score

Tradeable Symbols (Total): 1372

Year Founded: 2009

Publicly Traded (Listed): No

Bank: No

XM Group is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). XM Group is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

XM Group is considered average-risk, with an overall Trust Score of 90 out of 99.

Pros 👍🏻

- Offers 1,230 CFDs, including 57 forex pairs.

- Autochartist and Trading Central complement in-house research offering.

- The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

- Excellent research content that includes daily videos, podcasts, and organized articles.

- In-house broadcasting features TV-quality video content, and live recordings.

- A comprehensive selection of educational webinars, articles, and Tradepedia courses.

- Offers full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

Cons 👎🏻

- Standard account spreads are expensive compared to industry leaders.

- Average spreads are not published for the commission-based XM Zero account.

Overview

XM is a MetaTrader-only broker that is known to offer an outstanding selection of high-quality educational content and market research. XM is available globally and has some of the lowest fees in the industry.

Fees and Spreads

- XM has a low and incredibly competitive spread when compared to what other brokers offer by offering a spread list from as low as 1 pip along with zero commissions charged on trades on most accounts, except the Shares Account.

- XM trading fees are according to the type of account that the trader chooses and the options along with the spread list, leverage, minimum deposit required, and commissions are as follows:

-

Micro Account

– minimum deposit of $5, leverage from 1:1 to 1:888, spreads from as low as 1 pip, and zero commissions.

-

Standard Account.

– minimum deposit of $5, leverage from 1:1 to 1:888, spreads from as low as 1 pip, and zero commissions.

-

XM Ultra-Low Account

– minimum deposit of $50, leverage from 1:1 to 1:888, spreads from 0.6 pips, and zero commissions.

-

Shares Account

– minimum deposit of $10,000, no leverage and commissions charges as per the underlying exchange from $1 up to $9.

- The spread is the difference between the bid and asks the price of a financial instrument and brokers have various ways in which this is offered; it can either be fixed, variable, or floating.

- Fixed spreads are not subjected to factors such as market conditions and may stay the same, depending on the broker’s own conditions whereas other spreads may change, either increasing or decreasing, although, the lowest possible spreads are 0.0 pips.

- Different brokers offer different spreads as part of their trading conditions and spreads can be classified either as tight, where they are lower, or wide, where the pips are more. For instance, 0.0 pips are tight whereas 4.0 pips are wider.

Fees

What Can I Trade With XM?

After regulation, safety, and the fee structure, the next most important element to consider when choosing a Forex / CFD brokerage is what is offered for trading on the broker’s menu. Some traders will be seeking exposure only to one asset class, such as Forex, or CFDs on individual stocks and shares, while others will be looking for diversification.

XM offer the following instruments for trading:

Forex – more than 55 currency pairs and crosses, including exotic currencies, as listed below.

Stocks – an extremely wide selection of individual stocks are offered for trading, with more than 1,200 different equities currently listed by XM. This is a very impressive, wide range of choice offered as an access to global equities. Stocks are offered from seventeen different national equity markets, including of course the major markets such as the U.S.A., the U.K., Germany, Switzerland, and Australia, but also Russia. Otherwise, the geographical markets are entirely European. Traders interested in trading individual major market stocks should give XM serious consideration as a broker of choice.

Commodities – a decent selection of 8 soft commodities are offered, which is more than most brokerages run to. They are listed below.

Five energies, including natural gas, are available to trade.

The final element of XM’s commodities offering are precious metals, namely, gold and silver. More exotic precious metals such as platinum and palladium are not available.

Equity Indices – 18 major equity indices are on the menu, which is a decently wide-ranging selection for choice. The full list of equity indices is set out below.

Our conclusion regarding XM’s offering of tradable assets is favorable, with a wide range of asset classes offered that should satisfy most traders. The offering is especially impressive concerning global equities, with an unusually large amount (over 1,200) on the menu at the time this review was published. We expect there is a sufficiently wide range here for those traders who are not particularly interested in individual stocks and shares, but who want to be reasonably diversified across major markets.

XM Trading Hours

They are between Sunday 22:05 UTC and Friday 21:50 UTC, with most trading opportunities from the official start of the London trading session at 08:00 UTC, until the close of the New York trading session at 22:00 UTC. The Asian trading session, led by Tokyo opening at 23:00 UTC and closing at 06:00 UTC, presents the third most liquid one. The overlap between the London and New York open, between 13:00 UTC and 16:00 UTC, is where most of the trading activity occurs. The high liquidity during the three hours results in the tightest spreads. It is a development that scalpers and other short-term traders depend on for increased profitability.

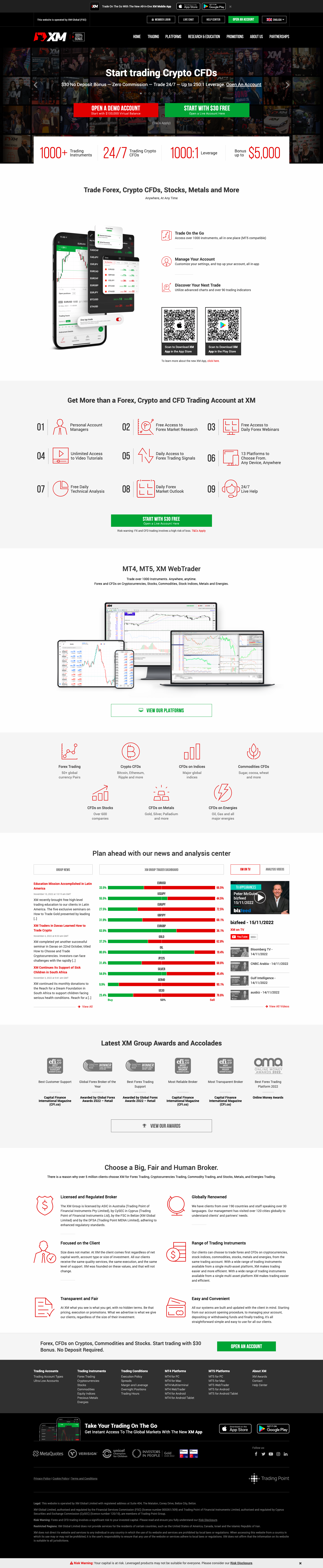

XM Account Types

There are 4 types of account:

- MICRO – allows you to operate with micro lots, lower level of risk and it has minimum initial deposit of $5.

- STANDARD – allows you to operate with standard lots and it has minimum initial deposit of $5.

- ZERO – account allows you to operate with standard lots, lower spreads starting at 0 pips and it has minimum initial deposit of $100. XM ZERO account has a $3.5 commission per $100,000 traded.

- ULTRA LOW (with low spreads) – allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50.

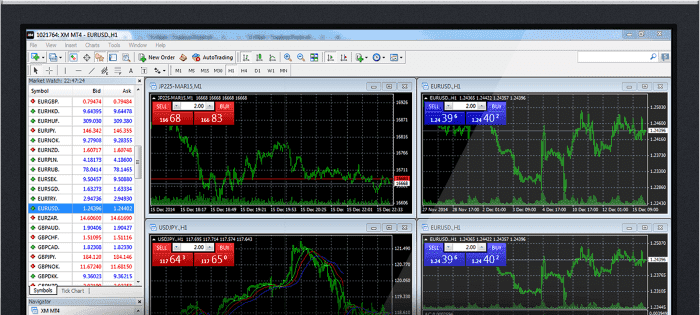

XM Trading Platforms

XM offers all its trader clients a choice between the use of the two most popular retail Forex trading platforms globally. Clients with any account type may choose to use either MetaTrader 4 or MetaTrader 5. Both platforms are well-known, intuitive, and easy to understand, and have been around for many years. Both platforms are also very popular with the retail trading community. Some traders may wish for a deeper choice of platform that is given here, yet a big majority of traders who find themselves considering becoming customers of XM will find the choice on offer adequate.

XM offers a range of MT4 and MT5 platforms for both Windows and Mac Operating Systems which gives traders unrestricted access to all platforms.

In addition, a range of MT4 and MT5 Mobile applications for both Apple and Android Operating Systems seamlessly allow access to an account with full account functionality from a smartphone or tablet.

MT4

XM pioneered the offering of an MT4 platform with trading execution quality in mind. It offers the following benefits: Over 100 Instruments including Forex, CFDs and Futures, 1 login access to 8 platforms, spreads as low as 1 pip, full EA (Expert Advisor) functionality, 1 click trading, technical analysis tools with 50 indicators and charting tools and 3 different chart types.

Trades can trade with the MT4 platform on their Mac as well as on mobile devices such as Androids and iPhones, iPads and tablets.

XM WebTrader 4

XM WebTrader 4 is accessible for PC’s and Mac’s without downloading. Traders can choose from over 100 Instruments Including Forex, CFD’s and Futures, 1 single login access to 8 Platforms, spreads as low as 1 pip, 1 click trading and built in news functionality.

The MT4/MT5 WebTrader provides the same functions as the desktop client but does not require downloading a trading terminal. It is compatible with all operating systems. All trading operations are available, and the only notable difference is that the MT4/MT5 WebTrader does not support EAs or the build-in copy-trading function, which rank among the best features. Traders must use the desktop version if they require them. The MT4/MT5 WebTrader suits manual traders who seek a lightweight trading platform and traders who frequently trade from different locations and devices. For the best trading experience, there is no substitute for the MT4/MT5 desktop trading platforms.

XM MT4 Multiterminal

The XM MT4 Multiterminal platform is the ideal tool for traders wanting to handle multiple MT4 account from 1 single terminal with ease with 1 Master Login and Password.

It supports up to 128 trading accounts, has multiple order types, three allocation methods and provides management and execution in real time.

MT5

MetaTrader 5 offers a range of extra features that analyze the market and help traders trade in any style they want.

In addition to all the features of the MT4 platform, the MT5 platform also offers different order types such as ‘Fill or Kill’ and ‘Immediate or Cancel’ as well as technical and fundamental analysis using over 79 analytical tools.

Mobile Trading

The popularity of mobile trading did not go unnoticed at XM, which offers mobile apps for the MT4 and MT5 trading platforms for Android and Apple devices. They operate on mobile phones and tablets, provide full MT4/MT5 functionality, support three chart types and 30 technical indicators. Real-time interactive charts and built-in market analysis tools exist. Despite millennial traders favoring mobile trading apps, committed traders use them only to monitor portfolios. Given the limited screen space, profitable traders conduct market research, technical analysis, and portfolio management on the desktop client or the web-based alternative. XM provides the necessary links to Google Play and the App Store for the swift installation of the desired mobile trading apps.

Reviews

There are no reviews yet.